Financial Services Industry Petitions the SEC for a Rulemaking to Amend the Cybersecurity Risk Management, Strategy, Governance and Incident Disclosure Rule

Debevoise’s Capital Markets Group and Data Strategy and Security Group recently assisted five leading financial services industry trade associations in preparing a joint rulemaking petition in response to the SEC’s cybersecurity disclosure rule. The petition called for the rescission of Form 8-K Item 1.05 and corresponding Form 6-K requirements. The industry’s position is that proposed rescission would restore a more balanced, principles-based cybersecurity disclosure regime that would provide more meaningful, decision-useful information to investors without imposing undue burdens or creating new risks for public companies.

In particular, the petition highlights the following shortcomings of Item 1.05:

- Exposes victims to further harm. Item 1.05’s four business day disclosure requirement for material cybersecurity incidents often forces premature disclosure when investigation and remediation efforts remain ongoing.

- Complex and resource-straining delay mechanism. The narrow exception permitting delayed disclosure requires the diversion of critical company and law enforcement resources to rapidly assess preliminary information for case-by-case determinations.

- Persistent market confusion. Companies have struggled to navigate the boundary between mandatory and voluntary disclosure of cybersecurity incidents.

- Chilling effect on internal communications and information sharing. Risks relating to disclosure compliance, securities laws liability and Regulation FD may cause legal departments and incident response teams to curtail internal correspondence and external information sharing.

- Weaponization by cyber criminals. Item 1.05 has been leveraged and weaponized by hackers as an extortion tool, exacerbating the financial and operational damage to victim companies and undermining the purpose of the disclosure rule.

For more information, see Debevoise Data Blog post.

SEC to Consider Foreign Private Issuer Eligibility

On June 4, 2025, the SEC issued a concept release on potential changes to the definition of “foreign private issuer” (“FPI”) for purposes of U.S. federal securities laws. FPIs benefit from significant disclosure and other accommodations under the Securities Act of 1933, as amended (the “Securities Act”), and Securities Exchange Act of 1934, as amended (the “Exchange Act”). The concept release solicits public comments on whether the current eligibility criteria for FPI status should be modified in light of significant changes to the FPI population since the SEC’s last review of the FPI framework in 2008.

Background. An FPI is any foreign issuer other than a foreign government, except for an issuer meeting the following conditions:

- More than 50% of the issuer’s outstanding voting securities are directly or indirectly held of record by residents of the United States; and

- Any of the following under the “business contacts test”: (1) the majority of the executive officers or directors are United States citizens or residents; (2) more than 50% of the assets of the issuer are located in the United States; or (3) the business of the issuer is administered principally in the United States.

FPI status is determined annually as of the end of a company’s second fiscal quarter for companies registered under the Exchange Act or within 30 days prior to filing an initial registration statement under the Securities Act or Exchange Act.

The current accommodations for FPIs were based on the expectation that most FPIs would be subject to meaningful disclosure and other regulatory requirements in their home country jurisdictions. According to the concept release, if an FPI is not subject to “meaningful requirements in its home country jurisdiction that elicit disclosure in a timely manner,” the definition of FPI may need to be modified.

Potential Approaches to a Revised FPI Definition. The concept release seeks public input on the following possible approaches to amending the FPI eligibility criteria:

- Updating existing FPI eligibility criteria, either by increasing the thresholds applicable to non-U.S. connections (i.e., shareholders, assets, directors/officers) or revising the criteria under the business contacts test;

- Applying a foreign exchange trading volume requirement;

- Applying a “major foreign exchange” listing requirement;

- Incorporating an SEC assessment of foreign regulations applicable to the FPI;

- Establishing new mutual recognition systems, similar to the existing MJDS framework (currently applicable only to certain Canadian companies); or

- Applying an international cooperation arrangement requirement.

Takeaways. The public comment period for the concept release closes on September 8, 2025, and interested parties can review comment letters as they are submitted. While a concept release is only the beginning of the process for reevaluating the definition of FPI (with any proposed rules subject to a separate rule-making process), given the release’s unanimous support by all four SEC commissioners and the current administration’s increased focus on addressing perceived competitive disadvantages for U.S. companies, current and potential FPIs are advised to continue closely monitoring these developments.

For more information, see Debevoise Update.

SLB 14M: Insights from the 2025 Proxy Season

On February 12, 2025, the staff of the SEC’s Division of Corporation Finance (the “Staff”) issued Staff Legal Bulletin No. 14M, which rescinded Staff Legal Bulletin No. 14L and reinstated earlier guidance on the exclusion of shareholder proposals. Under former SEC Chair Gary Gensler, the SEC had narrowed the substantive bases on which a Rule 14a-8 proposal could be excluded from a proxy statement under Rule 14a-8(i)(5)—the “economic relevance” exclusion—and Rule 14a-8(i)(7)—the “ordinary business” exclusion. SLB 14M reversed these changes.

The SEC issued SLB 14M in the middle of this year’s Rule 14a-8 proposal process. In a departure from typical protocol, issuers that had submitted no-action requests prior to the publication of SLB 14M were permitted to raise new legal arguments by submitting supplemental correspondence to the SEC, and issuers that had not submitted no-action requests could do so notwithstanding that their respective deadlines for submitting a no-action request had passed.

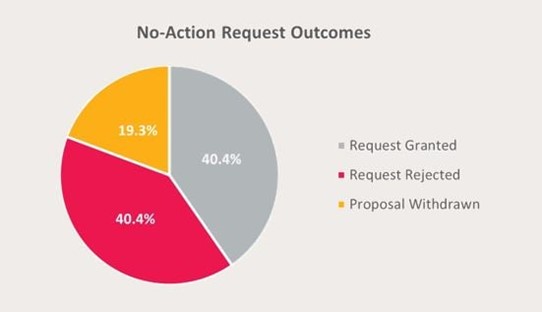

As of May 1, 2025, the Staff had issued responses to 57 no-action requests that included legal arguments relying on SLB 14M.

SLB 14M was expected to be particularly useful for issuers seeking to exclude ESG-related Rule 14a-8 proposals from their proxy statements—all of the responses we reviewed pertained to ESG-related proposals.

Although SLB 14M has been undoubtedly useful to issuers, it does not guarantee exclusion—of the no-action requests that were submitted, equal numbers were granted and rejected.

Most no-action requests (88%) included legal arguments based on the ordinary business exclusion. Of those, and excluding proposals that were withdrawn, 43% of the no-action requests were granted.

No-action requests that relied upon the economic relevance exclusion were less successful. Two of the 11 no-action requests that relied upon this exclusion and where the proposal was not withdrawn were granted.

In a significant shift, the Staff clarified in SLB 14M that its analysis of whether a proposal is “otherwise significantly related” under the economic relevance exclusion will no longer be informed by its analysis under the ordinary business exclusion, as has been the practice in recent years. As a result, proposals may be excluded on the grounds of economic relevance even when the ordinary business exclusion is not available, which may lead to more issuers considering it to be a viable basis for exclusion going forward.

For more information, see Debevoise Update.

Updated SEC Guidelines Bring Welcome Regulatory Clarity

In early March 2025, the Staff expanded and updated guidance with potential implications for the private equity industry. These changes include expanded accommodations for issuers to submit draft registration statements for nonpublic review, greater flexibility in written consents and “lock-up” agreements in M&A transactions and new clarifications to materiality thresholds in tender offers.

Broadened Accommodations for Draft Registration Statement Review.

Enhanced Accommodations. On March 3, 2025, the SEC expanded its guidance on confidential submissions and review of draft registration statements for IPO issuers and other Exchange Act filers through the following key changes:

- Expanding the initial registration statements eligible. The SEC will now permit issuers to submit for nonpublic review initial registration statements on Form 10, 20-F or 40-F under Exchange Act Section 12(g).

- Removing time constraints on review of subsequent draft registration statements. The SEC has removed the 12-month time limit and will now permit nonpublic review of subsequent draft registration statements regardless of when the issuer filed an initial registration statement.

- Expanding review to include de-SPAC transactions. The SEC will allow issuers to submit for nonpublic review registration statements in connection with de-SPAC transactions.

- Special considerations for Foreign Private Issuers. Foreign Private Issuers may, if they so qualify, choose to follow the procedures available to Emerging Growth Companies, or they can follow the alternative guidance issued in the SEC’s 2012 statement.

- Allowing issuers to omit underwriter(s) from initial draft registration statements.

Expanded Flexibility for M&A Sign-and-Consent Structures and Lock-Up Agreements.

Background

In business combination transactions involving target companies with a majority stockholder, an acquiror often requests that such stockholder delivers a written consent immediately after the signing of the transaction agreement. This “sign-and-consent” structure eliminates the need for a stockholder meeting to approve the transaction, accelerates the closing timeline and enhances acquiror’s deal certainty. Absent a written consent, acquirors will seek voting agreements where management and principal security holders commit to vote in favor of the transaction at the stockholders meeting, referred to as “lock-up agreements.”

Though not enforced in recent years, the SEC historically objected to sign-and-consent structures in transactions where the target company stockholders were to receive public (i.e., unrestricted) stock of the acquiring company as consideration.

Updated Guidance

Sign-and-consent structures

The SEC now formally permits registration of offers and sales of the acquiring company’s securities on Form S-4 (or Form F-4) when a sign-and-consent structure has been implemented, provided: (1) the insiders of the target company, who provided written consents, are offered and sold acquiring company securities only in an offering validly exempt from the Securities Act of 1933, as amended (the “Securities Act”), and (2) the registered securities (on either Form S-4 or F-4) are offered and sold only to security holders who did not sign on to such written consent.

Lock-up agreements

Four conditions must be satisfied to ensure the non-objection of Staff to the registration of offers and sales when significant stockholders (such as a private equity sponsor) sign lock-up agreements:

- the lock-up agreement involves only target company insiders, including executive officers, directors, affiliates, founders and their family members and holders of 5% or more of the voting equity securities of the target company;

- those signing the lock-up agreement own, in the aggregate, less than 100% of the target company’s voting equity securities;

- votes are solicited from the target company’s stockholders who have not signed lock-up agreements if required to approve the transaction under state or foreign law; and

- the acquiring company must deliver a prospectus to all target company security holders entitled to vote on the transaction.

New Guidance on Materiality Thresholds in Tender Offers.

New Guidance

The SEC also provided new guidance relating to tender offers, relevant to private equity sponsors and their portfolio companies engaging in liability management exercises or take-private transactions structured as a tender offer. The SEC’s five new Compliance and Disclosure Interpretations (C&DIs 101.17, 101.18, 101.19, 101.20 and 101.21) relating to tender offers provide greater insight into how the SEC views materiality thresholds, thus removing certain ambiguities regarding tender offer disclosures and allowing companies and private equity sponsors to more thoughtfully contract with lenders. The SEC’s relaxing of the five-business day requirement for all-cash tender offers allows companies and private equity sponsors additional flexibility and certainty in structuring offers, including in the take-private context.

For more information, see Debevoise Update.

Second Circuit Limits Short-Swing Trading Claims Under Section 16(b)

On May 23, 2025, the United States Court of Appeals for the Second Circuit upheld two district court decisions, Roth v. LAL Family Corp., et al. and Roth v. Patrick Drahi, et al., holding that a controlling shareholder’s sales of a company’s stock cannot be matched with that company’s own stock buybacks to establish liability under Section 16(b) of the Exchange Act. The Court rejected a shareholder’s claim that the controlling shareholders of two corporations wrongfully profited $56.7 million and $17.3 million through these stock buybacks.

The plaintiff-shareholder argued that the controlling shareholders had a financial interest in the shares repurchased by the company and that these buybacks should be treated as “purchases” to be matched with the controlling shareholders’ sales of company stock under Section 16(b). Based on this, the plaintiff sought to hold the controlling shareholders liable for short-swing profits subject to mandatory disgorgement under Section 16(b), which requires corporate insiders to return any short-swing profits realized from the purchase and sale of a company’s securities by insiders within a six-month period. However, the Court held that Section 16(b) does not apply when the buyer is the corporation itself.

The Court explained that Section 16(b) only applies to transactions involving “substantively identical equity securities.” The Court further explained that the repurchased shares are materially different from the shares sold by the controlling shareholders since, under Delaware law, the repurchased shares become “treasury shares,” which lose all ownership rights and value. As a result, the controlling shareholders could not have realized any profit because the treasury shares cannot be considered “substantively identical” to the controlling shareholders’ sold shares.

The Court found that accepting the plaintiff’s argument would create an illogical situation allowing companies to trigger insider liability through their own stock buybacks. The Court also noted that the plaintiff’s interpretation would conflict with the strict liability nature of Section 16(b), effectively turning it into a “trap sprung” by every transaction.

In May 2025, the Eleventh Circuit heard oral argument on an appeal of a Florida District Court’s decision rejecting the exact same legal theory.

Section 16(b) Claim for OTC-Traded Security Dismissed Based on Impermissible Extraterritoriality

On May 23, 2025, the U.S. District Court for the Southern District of New York dismissed a shareholder derivative action against Koichi Ishizuka (“Ishizuka”) and White Knight Co. Ltd. (“White Knight” and, together with Ishizuka, the “Defendants”) that sought disgorgement of short-swing profits allegedly derived from transactions in the common stock of Next Meats Holdings, Inc. (“Next Meats”) in violation of Section 16(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on the basis that applying Section 16(b) to the transactions at issue would be “impermissibly extraterritorial.”

Background. According to the opinion, White Knight, a Japanese entity owned and controlled by Ishizuka, the chief executive officer of Next Meats, engaged in a sale and then purchase of Next Meats stock within six months of each other, generating nearly $400,000 in profits for the Defendants (the “Transactions”). Next Meats shares only trade on the over-the-counter (“OTC”) market in the United States. Next Meats received a demand from one of its shareholders to prosecute the Defendants under Section 16(b) of the Exchange Act. The Defendants argued that, among other things, applying Section 16(b) to the Transactions would constitute an impermissible extraterritorial application of Section 16(b).

Analysis. Section 16(b) of the Exchange Act imposes strict liability on statutory “insiders” of an issuer (its officers, directors and shareholders owning greater than 10% of a class of its outstanding equity securities registered under Section 12 of the Exchange Act) in respect of “short-swing profits,” requiring them to disgorge to the issuer any profits gained from the purchase and sale, or sale and purchase, of the issuer’s registered equity securities within any six-month period.

The Defendants argued, however, that because the Transactions occurred outside the United States, and Next Meats’ common stock was not listed on a U.S. exchange, Section 16(b) should not apply. In general, an assumption against extraterritoriality exists where a statute is primarily concerned with domestic conditions. To interpret this presumption against extraterritoriality with respect to the provisions of the Exchange Act, courts have looked to the “transactional test” set out by the Supreme Court of the United States in Morrison v. National Australia Bank Ltd. Under the “transactional test,” a plaintiff may bring an action alleging that a transaction violates the Exchange Act if either (i) the transaction involved “a security listed on a U.S. exchange” or (ii) the transaction occurred in the United States.

As to whether the Transactions involved securities “listed on a U.S. exchange,” the plaintiff argued that securities that trade only on the OTC market in the United States are considered “listed on a domestic exchange” for purposes of the Morrison test. The Court rejected this argument, noting that for over a decade, courts in the Second Circuit have consistently found that the OTC market is not a domestic exchange for purposes of the Morrison test.

With regard to whether the Transactions occurred in the United States, a transaction occurs in the United States for purposes of the Morrison test if the parties incurred liability in the United States (meaning that the parties incurred an irrevocable obligation to take and pay for or to deliver, as applicable, securities within the United States) or if title to securities was transferred in the United States. As the plaintiff did not allege any facts that would support the argument that irrevocable liability was incurred in the United States, and the Court was unpersuaded by the plaintiff’s argument that title to the common stock was transferred in the United States, the Court found that the second prong of the Morrison test was also not satisfied. As a result, the case was dismissed.

For more information, see Debevoise Update.

Early Signs of America First Investment Policy Implementation Are Here

Since the release of the America First Investment Policy on February 21, 2025, the Trump administration has made its foreign investment objectives and intended outcomes clear. Until recently, however, the specific methods for implementing these objectives had not been fully articulated. That is starting to change.

While we previously addressed the release of the America First Investment Policy, recent remarks from Deputy Secretary of the Treasury Michael Faulkender delivered at the American Conference Institute’s annual conference on the Committee on Foreign Investment in the United States (“CFIUS”) offered key insight into the administration’s evolving approach to investment screening and national security risk mitigation and how it is both similar to and different from prior foreign investment policy. Not long after these remarks, the Department of the Treasury announced initial plans for the “fast-track” CFIUS review first mentioned in the America First Investment Policy, and the Trump administration announced the U.S.-U.K. Economic Prosperity Deal, which includes terms for bilateral cooperation regarding investment security. These developments signal that implementation of the America First Investment Policy has begun in earnest, and the Deputy Secretary’s remarks provide a road map of what to expect next.

Implementation of the America First Investment Policy.

The America First Investment Policy aims to (i) attract capital from allied countries, (ii) reduce regulatory burdens on low-risk transactions and (iii) increase protections against foreign adversarial influence, with a particular focus on the People’s Republic of China. The policy supports reforms across both inbound and outbound investment channels and signals a move toward greater proportionality and predictability in U.S. national security reviews.

In his April 24, 2025 remarks, Deputy Secretary Faulkender outlined how the Trump administration is implementing this policy and how it will impact CFIUS, while also providing updates on the recently launched Outbound Investment Security Program. He outlined a set of strategic priorities guiding the Treasury Department’s execution of the policy including:

- Making the United States a primary place for benign foreign investment from U.S. allies and partners;

- Reducing uncertainty and unnecessary regulatory burdens on investors, such as through a “fast-track” review for investors from U.S. ally and partner nations and streamlining CFIUS mitigation measures to make them more proportionate;

- Increasing investment review collaboration with foreign allies and partners by urging allies to adopt and enforce robust screening mechanisms to prevent foreign adversaries from using third-country investments to bypass U.S. controls; and

- Continuing and improving the Outbound Investment Security Program, which imposes either a notice requirement or an outright prohibition on U.S. person investments involving China-related parties engaged in certain quantum information technology, artificial intelligence and semiconductor and microelectronics activities.

For more information, see Debevoise Update.

Recent SEC Actions Signal a Positive Shift for Expanding Retail Access to Private Markets Strategies

Funds regulated under the Investment Company Act of 1940, as amended (“Regulated Funds”), including business development companies (“BDCs”) and closed-end funds, have played a pivotal role in providing retail investors with access to alternative asset classes, including private credit and private equity. However, their operational frameworks were often hamstrung by procedural rigidity and regulatory limitations that made them less agile compared to their private fund peers. The SEC’s willingness over the last three months to review and update some of these historical regulatory positions comes as a welcome development.

The SEC’s most recent updates indicate the possibility of increased operational flexibility, broader fundraising pathways and reduced compliance burdens in the future that could unlock significant opportunities for retail investors and fund sponsors.

Modernization of Co-Investment Exemptive Relief

On April 29, 2025, the SEC issued an order granting an application for more flexible co-investment exemptive relief for Regulated Funds. Under the Investment Company Act, Regulated Funds are generally restricted from jointly negotiating or participating in certain investments alongside affiliates, unless they obtain SEC exemptive relief. The process for obtaining that relief can be complex and burdensome. However, the new, more flexible co-investment relief should ease some of these burdens. Such relief includes:

- Streamlined allocation processes;

- Removal of the “propping up” restriction;

- Expanded participation in follow-on deals;

- Reduced board approval thresholds;

- Broader definition of eligible affiliates; and

- Streamlined compliance and reporting.

Multi-Share Class Exemptive Relief: A New Frontier for BDC Distribution

In April 2025, the SEC took another step forward by granting multi-share class relief to private BDCs. This expansion of the multi-share class relief will allow, for the first time, a private BDC to offer multiple share classes featuring differentiated distribution and servicing fees tailored to specific distribution channels, such as registered investment advisers, broker-dealers and institutional investors. This shift will bring several advantages, such as market reach expansion, alignment with industry norms and operational efficiency.

Minimum Investment-Based Accredited Investor Verification: A New Fundraising Opportunity

On March 12, 2025, the SEC issued interpretive guidance confirming that the following minimum investment thresholds can satisfy “accredited investor” verification requirements for Rule 506(c) offerings:

- $1,000,000 for entity investors and

- $200,000 for natural person investors.

This much-needed guidance should increase the ability of a fund (including a privately offered Regulated Fund) to raise additional capital from investors.

Implications and Outlook

Together, these updates reflect a significant recalibration of the SEC’s posture toward revising its regulatory positions in response to marketplace modernizations. By removing outdated constraints, simplifying compliance and enhancing flexibility, the SEC is signaling regulatory innovation and design in the Regulated Fund space while maintaining focus on core investor protections. With further expansion and broader application, these and future updates could significantly bolster growth and competitiveness in the asset management space by attracting new asset management entrants to the retail market.

For more information, see Debevoise Update.

UK Government Publishes New Regulations on PISCES

On May 15, 2025, HM Treasury published regulations (the “Regulations”) that create the legal framework for the Private Intermittent Securities and Capital Exchange System (“PISCES”), a new trading venue intended to facilitate the trading of shares of private companies. The Regulations came into force on June 5, 2025.

Background. The Regulations establish the PISCES sandbox under the Financial Market Infrastructure provisions of the Financial Services and Markets Act 2023 and set out the framework for prospective PISCES operators to apply to the UK Financial Conduct Authority (the “FCA”) to operate intermittent trading events for participating private companies and investors.

Key Features of PISCES. Under the Regulations, PISCES is defined as a multilateral system that, among other things, should accommodate at least one of the following features: (i) when shares may be traded, (ii) who may buy or sell the shares, (iii) restrictions on share trading (for example, minimum or maximum prices) or (iv) to whom company information may be disclosed.

The explanatory memorandum accompanying the Regulations (the “Memorandum”) highlights a number of distinctive features of the PISCES regime:

- PISCES will function exclusively as a secondary market platform for the trading of existing shares in private companies. Primary capital raising through the issuance of new shares, as well as trading in other securities, such as debt instruments, will not be permitted.

- The FCA will have rulemaking powers to develop a tailored disclosure and transparency regime specific to PISCES.

- PISCES operators will have discretion over whether shares must be recorded in a central securities depository.

- Only shares in companies that are not currently admitted to trading on a public market, whether in the United Kingdom or elsewhere, will be eligible for trading on PISCES.

- PISCES operators will be able to determine admission criteria to their platforms, including any minimum corporate governance standards.

- Participating companies will have discretion as to the timing of trading windows, the eligibility of potential purchasers and pricing, subject to the operator’s business model and FCA oversight.

- Trading will generally be limited to professional investors and employees of participating companies, with retail investor participation broadly prohibited. The new regime also prohibits intermediaries from facilitating share buybacks via the PISCES platform.

- PISCES will not be available to trade in options or other derivatives.

Eligible Operators. The Regulations set out that only certain categories of authorized firms are eligible to operate a PISCES platform.

Liability. Companies whose shares are traded on PISCES will be required to make certain core disclosures. For information required by the FCA’s core disclosure rules, companies may be held liable on a negligence basis. For disclosures not falling within the core category, companies will only be liable if the relevant officers acted recklessly or dishonestly.

For more information, see Debevoise Update.

Selected Recent Securities Law Legislation Proposals

A summary of selected recent securities-law related legislation proposed in May 2025 follows.

|

Proposed Legislation

|

|

Name of Bill

|

Description of Bill

|

Latest Action

|

|

H.R.3135

|

To amend the Securities Act to automatically qualify offering statements filed with the SEC in connection with certain securities issued under Regulation A tier 2, and for other purposes.

|

House - 05/01/2025 Referred to the House Committee on Financial Services.

|

|

H.R.3314

|

To prohibit the issuance, promotion, or sale of digital assets that use the name, likeness, or identifiable traits of certain federal officials or their immediate family for financial gain, and to establish regulatory oversight under the SEC.

|

House - 05/08/2025 Referred to the House Committee on Financial Services.

|

|

H.R.3301

|

To amend the Exchange Act to specify certain registration statement contents for emerging growth companies, to permit issuers to file draft registration statements with the SEC for confidential review, and for other purposes.

|

House - 06/03/2025 Placed on the Union Calendar, Calendar No. 91.

|

|

S.1670

|

A bill to amend the Investment Advisers Act of 1940 to require investment advisers for passively managed funds to arrange for pass-through voting of proxies for certain securities, and for other purposes.

|

Senate - 05/08/2025 Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

|

|

H.R.3422

|

To amend the Exchange Act to require the Advocate for Small Business Capital Formation to provide educational resources and host events to promote capital raising options for traditionally underrepresented small businesses, and for other purposes.

|

House - 06/03/2025 Placed on the Union Calendar, Calendar No. 87.

|

|

H.R.3402

|

To amend the Exchange Act to require certain disclosures by institutional investment managers in connection with proxy advisory firms, and for other purposes.

|

House - 05/14/2025 Referred to the House Committee on Financial Services.

|

|

H.R.3394

|

To amend the Securities Act to codify certain qualifications of individuals as accredited investors for purposes of the securities laws.

|

House - 06/03/2025 Placed on the Union Calendar, Calendar No. 85.

|

|

H.R.3383

|

To amend the Investment Company Act of 1940 with respect to the authority of closed-end companies to invest in private funds.

|

House - 05/20/2025 Ordered to be Reported (Amended) by the Yeas and Nays: 41 - 10.

|

|

H.R.3381

|

To amend the Securities Act to expand the ability to use testing the waters and confidential draft registration submissions, and for other purposes.

|

House - 06/03/2025 Placed on the Union Calendar, Calendar No. 86.

|

|

H.R.3357

|

To amend the Exchange Act to require issuers with a multi-class stock structure to make certain disclosures in any proxy or consent solicitation material, and for other purposes.

|

House - 06/03/2025 Placed on the Union Calendar, Calendar No. 90.

|

|

H.R.3352

|

To require the SEC to revise rules relating to general solicitation or general advertising to allow for presentations or other communication made by or on behalf of an issuer at certain events, and for other purposes.

|

House - 06/03/2025 Placed on the Union Calendar, Calendar No. 93.

|

|

H.R.3348

|

To amend the Securities Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) with respect to the definition of accredited investor, and for other purposes.

|

House - 06/04/2025 Placed on the Union Calendar, Calendar No. 103.

|

|

H.R.3343

|

To amend the Federal securities laws to specify the periods for which financial statements are required to be provided by an emerging growth company, and for other purposes.

|

House - 06/03/2025 Placed on the Union Calendar, Calendar No. 89.

|

|

H.R.3339

|

To require certification examinations for accredited investors, and for other purposes.

|

House - 06/03/2025 Placed on the Union Calendar, Calendar No. 97.

|

|

H.R.3318

|

To require the reorganization of certain offices within the SEC, and for other purposes.

|

House - 05/09/2025 Referred to the House Committee on Financial Services.

|

|

H.R.3645

|

To amend the Securities Act to raise the offering amount threshold for when issuers using the crowdfunding exemption are required to file financial statements reviewed by a public accountant who is independent of the issuer, and for other purposes.

|

House - 05/29/2025 Referred to the House Committee on Financial Services.

|

|

H.R.3633

|

To provide for a system of regulation of the offer and sale of digital commodities by the SEC and the Commodity Futures Trading Commission, and for other purposes.

|

House - 05/29/2025 Referred to the Committee on Financial Services, and in addition to the Committee on Agriculture, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned.

|

|

S.1877

|

To direct the SEC to promulgate rules with respect to the electronic delivery of certain required disclosures, and for other purposes.

|

Senate - 05/22/2025 Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

|

|

S.1808

|

To permit a registered investment company to omit certain fees from the calculation of acquired fund fees and expenses, and for other purposes.

|

Senate - 05/20/2025 Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

|

|

H.R.3484

S.1806

|

To terminate unused authorities of the SEC that were established pursuant to the Dodd-Frank Act.

|

House - 05/19/2025 Referred to the House Committee on Financial Services.

Senate - 05/19/2025 Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

|

This publication is for general information purposes only. It is not intended to provide, nor is it to be used as, a substitute for legal advice. In some jurisdictions it may be considered attorney advertising.