In 2026, companies and individuals conduct many important transactions using images of objects or documents, rather than the original items themselves. For example, individuals authenticate themselves using photos of their passports; banks process and accept check deposits using images of these checks; employers reimburse employees for expenses submitted with pictures of receipts; and insurers pay claimants based on submitted images of damage to their cars or properties.

Over the last few months, advances in generative AI have given rise to models, such as Google’s Gemini 3, that can create photorealistic images and can therefore fabricate the kinds of images relied upon in these commercial validation workflows.

For insurers in particular, this technology poses a significant risk of an increasing number of fabricated or exaggerated claims, which could have downstream consequences for loss reserving practices.

EXAMPLES OF EXAGGERATED LOSS CLAIMS

A claimant could misuse AI in this way to obtain a payment from an insurance company for a nonexistent claim or for a claim that greatly exceeds the cost of the actual repairs.

DETECTION TECHNIQUES. There are several techniques that insurance companies can use to detect this kind of fraud, including:

- Requiring several photos of the damage from multiple angles and distances, and the inclusion of a reference object in the photos to help validate scale.

- Use of software for detecting AI-generated images.

- Requiring claimants to submit native files or the original documents by mail.

- Use of real-time remote video inspection of the damage (e.g., using Facetime), through which an adjuster directs the claimant to pan, zoom and capture specific features.

- Increasing on-site visits to validate claims.

In selecting a methodology to detect this kind of fraud, insurers should take care not to overcorrect and either significantly slow down or wrongly deny legitimate claims.

IF INSURERS DETECT FRAUD. If an insurer determines that a legitimate insurance claim used a fabricated image to enhance damage and thereby exaggerate the claim, the insurer must then decide whether to pay the legitimate portion of the claim, or deny the claim outright.

Many property policies contain conditions that can bar coverage altogether when the insured intentionally misrepresents material facts in connection with the policy or a claim. While wording varies, most policies contain language to the effect of:

This entire policy shall be void if the insured has intentionally concealed or misrepresented any material fact, made any false statements or committed fraud in connection with a claim.

Additionally, state insurance anti-fraud frameworks often criminalize knowingly false statements to insurers and require insurers to report such fraud, see, e.g., N.Y. Penal Law § 176.00 et seq.; N.Y. Insurance Law § 405(a).

However, even when policy language and regulations may support a total denial, insurers typically weigh several factors before issuing such a response, including:

- Proof risk: Whether the insurer shows intentional and material deception, as opposed to mistake, ambiguity, or aggressive estimating.

- Bad-faith and extra-contractual exposure: Total forfeiture positions can escalate disputes, especially if the claimant has some legitimate loss and can argue overreach.

- Regulator expectations and customer trust: Overly punitive approaches can create reputational harm and regulatory scrutiny, particularly if controls flag claims as fraudulent that turn out to be legitimate.

As a result, carriers often take a calibrated approach by paying the undisputed amount while denying the inflated portion in circumstances where the proof of fraud is not definitive. As a means of deterrence, carriers may deny the entire claim where there is strong indicia of fraud. In cases of repeated clearly fraudulent claims, insurers also consider a referral to law enforcement or to an insurance fraud bureau, especially if there is any indication of organized criminal conduct.

IMPACT ON LOSS RESERVING. Loss reserves are an estimate of an insurer’s liability from future claims it will have to pay out and the related costs for adjusting those claims. Insurers base those estimates on the insurer’s historical experience, the likelihood of a claim, litigation trends, expected losses, and inflation, among other factors. The risk of an increasing number of fraudulent claims, including artificially inflated claims, resulting from AI image manipulation, without effective methods to detect that fraud, could make it more difficult for insurers to estimate reserves accurately.

SIMILAR FRAUD PATTERNS IN OTHER CONTEXTS

| Fabricated employee lunch expense |

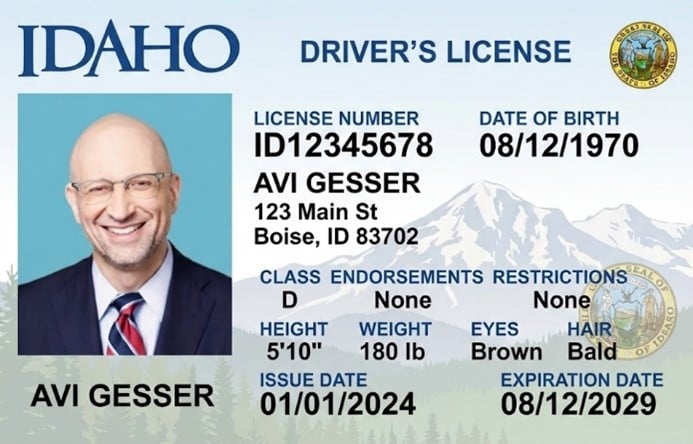

Fabricated identification |

|

|

In a world where seeing (in the case of digital images) is no longer necessarily believing, insurers (and, indeed, many organizations) that rely on digital images should assess the risk of fraud and determine how best to address that risk.

This publication is for general information purposes only. It is not intended to provide, nor is it to be used as, a substitute for legal advice. In some jurisdictions it may be considered attorney advertising.