Key Takeaways:

- A version of this article also appeared in Securities Docket on November 26, 2024. Access that version here.

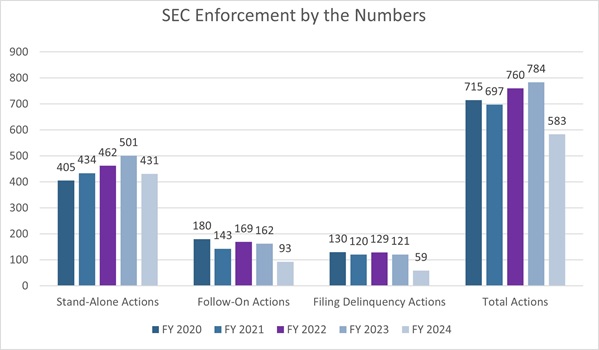

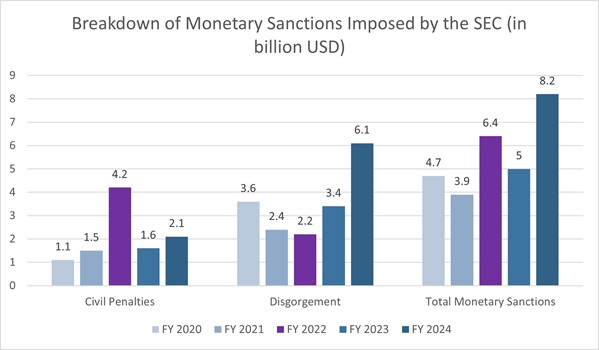

- On November 22, 2024, the U.S. Securities and Exchange Commission’s (“SEC”) Division of Enforcement (the “Division”) released its enforcement results for fiscal year (“FY”) 2024. This year, enforcement activity steeply declined: the SEC brought 583 actions, a 26% decrease from FY2023. And although the SEC reported a record-breaking $8.2 billion in disgorgement and penalties, 55% of that amount stems from one case against a company currently in bankruptcy proceedings.

- The SEC brought 431 stand-alone actions in FY 2024, a 14% decline from the prior year that was driven primarily by large drops in the number of securities offering cases and issuer reporting/audit and accounting cases. The SEC brought approximately 43% fewer of each type of action. It also initiated far fewer follow-on administrative actions and filing delinquency actions, which decreased by 43% and 51%, respectively.

- In FY 2024, cases reflecting the priorities of outgoing Chair Gary Gensler, including record-keeping violations arising from text messaging and cryptocurrency enforcement, made up a majority of the monetary remedies. Such actions are unlikely to contribute meaningfully in future years given the change in administration.

On November 22, 2024, the U.S. Securities and Exchange Commission’s (“SEC” or “Commission”) Division of Enforcement (“Division”) released its enforcement results for fiscal year (“FY”) 2024.The results, which were reported in a press release and an accompanying addendum, showed a 26% decline in the number of enforcement actions from FY 2023—and the lowest in the last 10 years. And, although disgorgement and penalties reached a new high of $8.2 billion, more than half that figure was attributable to a single case—the Commission’s enforcement action against the bankrupt Terraform Labs, which likely is uncollectible. In all, 62% of this year’s financial sanctions came from Terraform or off-channel communications enforcement cases. In addition, the amount returned to investors in standalone cases fell from $930 million in FY 2023 to $345 million.

In its press release, the SEC emphasized numerous focus areas, including recordkeeping violations, digital assets, and cybersecurity. Most observers expect these types of cases to wane after Chair Gary Gensler departs at 12:00 p.m. on January 20, 2025, when President-Elect Donald Trump will take office.

FY 2024 Statistics

The SEC brought 431 stand-alone actions—actions alleging violations that are not predicated on a prior finding of a violation—in FY 2024, a 14% decline from last year and the lowest total since 2020. It also brought far fewer follow-on administrative actions and filing delinquency actions, which declined 43% and 51% respectively, to their lowest totals since at least 2014.

The three most prevalent types of stand-alone actions were:

- Investment adviser and investment company matters (23% of the total);

- Securities offering matters (22% of the total); and

- Broker-dealer matters (14% of the total).

The year-over-year decline in standalone cases was driven primarily by large drops in the number of securities offering cases and issuer reporting/audit and accounting cases. The SEC brought approximately 43% fewer of each type of action. In addition, the number of FCPA cases declined from 11 to 2, an 82% drop. This decrease followed an uptick in FY 2023 and makes clear that FCPA enforcement was a lower priority in FY 2024 compared to areas of focus like crypto, off-channel communications, and the Marketing Rule. Only two categories of cases saw significant increases; the number of actions involving investment advisers or investment companies rose by 12%, and the number of public finance abuse cases more than doubled.

|

Standalone Enforcement Actions by Primary Classification

|

|

Primary Classification

|

FY 2020

|

FY 2021

|

FY 2022

|

FY 2023

|

FY 2024

|

|

|

Investment Adviser/ Investment Companies

|

21%

|

87

|

28%

|

120

|

26%

|

119

|

17%

|

86

|

23%

|

97

|

|

|

Broker-Dealer

|

10%

|

40

|

8%

|

36

|

10%

|

46

|

12%

|

60

|

14%

|

61

|

|

|

Securities Offering

|

32%

|

130

|

33%

|

142

|

23%

|

106

|

33%

|

164

|

22%

|

94

|

|

|

Issuer Reporting / Audit & Accounting

|

15%

|

62

|

12%

|

53

|

16%

|

76

|

17%

|

86

|

11%

|

49

|

|

|

Market Manipulation

|

5%

|

22

|

6%

|

26

|

7%

|

32

|

4%

|

22

|

4%

|

17

|

|

|

Insider Trading

|

8%

|

33

|

6%

|

28

|

9%

|

43

|

6%

|

32

|

8%

|

34

|

|

|

FCPA

|

2%

|

10

|

1%

|

5

|

1%

|

6

|

2%

|

11

|

0%

|

2

|

|

|

Public Finance Abuse

|

3%

|

12

|

3%

|

12

|

4%

|

19

|

1%

|

6

|

3%

|

14

|

|

|

SRO / Exchange

|

0%

|

0

|

0%

|

1

|

0%

|

1

|

1%

|

5

|

0%

|

1

|

|

|

NRSRO

|

1%

|

3

|

0%

|

2

|

0%

|

1

|

1%

|

4

|

1%

|

6

|

|

|

Transfer Agent

|

0%

|

1

|

0%

|

2

|

2&

|

7

|

1%

|

3

|

0%

|

1

|

|

|

Miscellaneous

|

0%

|

5

|

2%

|

7

|

1%

|

6

|

4%

|

22

|

13%

|

55

|

|

Greatest Total Monetary Remedies Ordered in SEC History

In FY 2024, the SEC imposed or won $8.2 billion in ordered or agreed monetary relief, the largest total in its history. It also set a record for disgorgement and prejudgment interest, which at $6.1 billion greatly exceeded the total financial remedies imposed in 2023, 2021, and 2020. FY 2024’s $2.1 billion in penalties was the second-highest amount on record, exceeded only by FY 2022’s penalty total.

Although the headline numbers are impressive, looking below the surface, they reflect very large contributions from a single crypto judgment ($4.5 billion in disgorgement and penalty) and the off-channel communications settlements ($600 million). These are unlikely to be recurring sources of significant penalties going forward, as the single judgment is necessarily a one-off, and the new Republican Commission is expected to focus efforts elsewhere.

Focus Areas

The SEC’s press release accompanying the results featured initiatives aimed at “off-channel” communications, the Marketing Rule, digital assets, cybersecurity, artificial intelligence, and relationship investment scams.

Recordkeeping Violations by Regulated Entities

Recordkeeping violations remained a major focus for the SEC in FY 2024 as part of its off-channel communications initiative. The SEC reported bringing record-keeping cases against more than 70 firms, yielding more than $600 million in penalties. The SEC specifically noted that this year it brought its first recordkeeping violations cases against municipal advisors. The 12 charged firms paid more than $1.3 million in penalties combined. The SEC’s emphasis on recordkeeping violations was consistent with trends from the past several years, but most expect that these cases will be winding down with the change in administration.

Marketing Rule

The SEC highlighted its continuing initiative to enforce compliance with the Marketing Rule, which resulted in settlements with more than a dozen investment advisers in FY 2024. There were a range of violations. Five firms were charged for advertising hypothetical performance on their websites without utilizing policies to ensure the relevance of that hypothetical performance to their intended audience. Nine firms were charged for violations related to advertisements with untrue or unsubstantiated statements of material fact, or testimonials, endorsements, or third-party ratings that did not have the required disclosures. One firm was charged for misleading performance advertising.

Digital Assets

The SEC won its first crypto-related trial in SEC v. Terraform Labs. The case concerned crypto asset securities fraud involving digital assets being sold as securities. The jury found Terraform Labs and its founder Do Kwon liable for securities fraud, and the court imposed over $4.5 billion in disgorgement, prejudgment interest, and penalties—including $200 million in remedies to be paid by Kwon himself. The case was somewhat unique in that Kwon, who was detained in Montenegro, did not attend the trial.

The SEC also settled crypto-related charges with Silvergate Capital. It charged Silvergate with false and misleading disclosures, both about the strength of its BSA/AML compliance program and how it monitored crypto customers, which included FTX.

Additionally, the SEC settled with Barnbridge DAO for failure to register its offer and for the sale of structured crypto assets offered and sold as securities.

Cybersecurity

The SEC highlighted a number of cases related to its cybersecurity enforcement efforts. The SEC settled with The Intercontinental Exchange, Inc. and nine subsidiaries, including the New York Stock Exchange, for failure to timely alert the SEC to a cyber intrusion, a violation of Regulation Systems Compliance and Integrity. The SEC also settled with R.R. Donnelley & Sons for disclosure and internal control failures in the cybersecurity incident space. Additionally, the SEC settled with Equiniti Trust Company, LLC regarding its failures to secure client securities and funds against theft or misuse.

Artificial Intelligence

The SEC continued to scrutinize investment firms for “AI washing” and settled with investment advisers Delphia and Global Predictions after charging them with making false and misleading statements about their use of AI in the investment process. Further, the SEC charged QZ Asset Management for allegedly falsely asserting that its AI technology could generate exceptional returns while client funds remained “100%” protected.

Relationship Investment Scams

The SEC also highlighted relationship investment scams, similar to affinity frauds it has highlighted in the past. This year, the SEC charged five entities and three individuals for their roles in two relationship investment scams using a fake crypto asset trading platform. The SEC alleges that the defendants sought out investors via social media, built up their trust, and then solicited investments on the fake crypto asset trading platform.

Gatekeepers

The SEC maintained its focus on gatekeepers, bringing actions against two audit firms as well as internal gatekeepers at a software company who were allegedly aware of fraud perpetrated by the CEO. Most notably, it charged the audit firm BF Borgers for a “massive fraud affecting more than 1,500 SEC filings.” The SEC declared that BF Borgers’ scheme, for which the firm and its owner agreed to pay a combined $14 million in penalties, constituted “one of the largest ever wholesale failures by a gatekeeper.” The Commission also charged the audit firm Prager Metis for misrepresenting compliance with auditing standards and violating auditor independence rules. To settle the charges, Prager paid $1.95 million in penalties and disgorgement.

The Commission also targeted the C-suite, charging the CFO and the audit committee chair of Kubient, an advertising software company, for perpetuating a fraud by the CEO, who also faced charges. The SEC alleged that, although the defendants knew the CEO had made misrepresentations about a software program, they failed to investigate further and instead made false statements that advanced the CEO’s scheme. According to the SEC, the action was a “signal to gatekeepers like CFOs and audit committee members that the SEC and the investing public expect responsible behavior when critical issues are brought to their attention.” Notably, this statement takes an expanded view of who qualifies as a gatekeeper, a category that has not traditionally included CFOs.

Cooperation and Self-Reporting

As it did last year, the SEC highlighted instances of market participants, “answering the Division’s call to practice a culture of proactive compliance.” Some of these regulated entities faced reduced penalties or no penalties. One such firm was J.P. Morgan Securities, which avoided a penalty after reporting that it had recommended certain mutual fund products to customers when less expensive comparable products were available. Among the other firms that faced no penalties were Qatalyst Partners, which self-reported widespread off-channel communications use, and CIRCOR, which self-reported accounting errors. Following their self-reports, all three firms cooperated with SEC staff and took prompt steps to remediate violations. However, cases like these may be the exception rather than the rule, as the SEC has had difficulty persuading firms to self-report in off-channel cases.

Individual Accountability

Emphasizing that “individual accountability” remains “essential,” the press release noted that the SEC issued 124 orders barring individuals from serving as directors and officers of public companies—the second-highest total in a decade. Most notably, it imposed $200 million in remedies and a permanent officer-and-director bar on Terraform Labs cofounder Do Kwon after a jury found him liable for crypto-related securities fraud. In another crypto-related matter, the SEC assessed penalties against Silvergate’s CEO and CRO of $1 million and $250,000, respectively, and imposed temporary officer-and-director bars.

Two other significant individual actions involved healthcare executives. The former CEO and former senior vice president of Cassava Sciences agreed to temporary officer-and-director bars and penalties to resolve charges related to misleading statements about an Alzheimer’s clinical trial. The SEC also brought an action against the CEO and other senior executives of Medly Health for fraudulently overstating the now-defunct startup’s revenue as it sought to raise capital.

Whistleblowers

In FY 2024, the SEC received a record-high 45,130 tips, complaints, and referrals. Of these, more than 24,000 were tips, an increase of about a third from FY 2023’s total of approximately 18,000. Notably, however, more than 14,000 of this year’s tips came from just two individuals. These same two individuals submitted over 7,000 tips in FY 2023. This increase exceeds the actual increase in tips for the year, effectively undermining its significance.

The dramatic rise in whistleblowing may have been motivated in part by FY 2023’s record-breaking $600 million whistleblower award total, $279 million of which went to a single individual. This year’s tips yielded a more modest $255 million in whistleblower awards, a figure in line with FY 2022’s $229 million total.

Further, in an action against J.P. Morgan, the SEC imposed the largest-ever penalty for a standalone violation of the Dodd-Frank whistleblower protection rule. The $18 million penalty was levied as part of a broader effort to target regulated entities that maintained confidentiality agreements or related agreements that potentially impede whistleblowing, including those that constrain clients’ and customers’ ability to contact the SEC or that require employees to waive their rights to whistleblower awards.

Market Abuse and Material Nonpublic Information

The SEC reported 34 insider trading actions, a small increase from last year. By historical standards, however, this is a low number, suggesting that the SEC may have de-prioritized insider trading enforcement. Nonetheless, the press release highlighted a diverse range of actions related to material nonpublic information (“MNPI”). The SEC brought or settled charges against investment adviser representatives for a “cherry-picking” scheme that allegedly “defrauded their clients out of millions,” against a hacker for illegally obtaining and trading on a public company’s MNPI, and against several investment advisers for failing to implement and enforce policies and procedures to prevent MNPI misuse.

Conclusion

In FY 2024, the SEC maintained a strong focus on crypto and off-channel communications, likely for the last time given the impending administration change. It also began to focus on new priorities that could be relevant in the coming year, particularly artificial intelligence.

In addition, the decline in new enforcement actions may stem, at least in part, from the SEC’s heavy litigation burden, particularly resulting from crypto matters. In FY 2023, the SEC filed more than 40% of its standalone matters as litigated matters—a relatively high percentage.While the Commission did not release this statistic for FY 2024, it likely had a similar litigation burden, including previously filed cases against large crypto exchanges and other crypto-related entities, which would likely have put a significant strain on the Division. Crypto cases tend to litigate more often given the novel issues involved and the existential nature of some cases, the latter of which often makes settlement impossible. Another driver of litigation may be the more aggressive settlement demands made by this administration, which also tend to make settlement less likely.

With the presidential administration set to imminently change, it is unlikely that the next Commission and Enforcement Director will fully embrace the priorities reflected in this year’s press release. In addition to moving away from Chair Gensler’s signature matters, i.e., crypto and off-channel communications, we expect the new administration to have a renewed emphasis on “bread and butter” enforcement matters that were in focus during the first Trump administration, including offering frauds, investment adviser fraud, and violations impacting retail investors.

This publication is for general information purposes only. It is not intended to provide, nor is it to be used as, a substitute for legal advice. In some jurisdictions it may be considered attorney advertising.