Key Takeaways:

- The UK Government has published draft legislation implementing a reform of the United Kingdom’s carried interest tax regime with effect from April 2026, following through on a pledge in the Labour Party’s 2024 election manifesto.

- The new regime entails an increase in the headline rate of tax, from 32% to roughly 34% for “qualifying” carried interest (or 47% if non-“qualifying”), and substantial technical changes that may affect carry recipients who spend any time working in the United Kingdom.

- Fund houses and affected carry recipients will need to consider, in particular: new average holding period rules for fund investments, which will determine whether carried interest is “qualifying”; the application of the regime to non-UK resident carry recipients; and, potentially, an earlier UK tax payment date for carry recipients.

Last week, the UK Government published draft legislation to enact a new regime for the UK taxation of carried interest, which will apply to carried interest distributions from 2026/27 onwards (with no grandfathering). This is the latest stage in the fulfilment of the Labour Government’s pledge in its election manifesto to close the “loophole” they regard as applicable only to the private equity industry through which “performance-related pay” (by which they mean carried interest) is treated as capital gains.

The new regime, which was first announced in the Autumn Budget in 2024, entails both an increase in the headline rate of tax on carried interest, from 32% to roughly 34%, and other, substantial changes to the taxation of carried interest. Fund houses will need to understand the qualifying conditions for the new regime, its interaction with international and other UK tax regimes and cash flow implications for carry recipients relating to their UK tax payments.

Reform of Carried Interest Taxation

Currently, carried interest in a typical fund partnership structure is treated as investment profits and is taxed based on the underlying proceeds that give rise to a carry distribution, whether capital (typically taxed at 32%, up from 28% in 2024/25), dividends (typically 39.35%) or interest and other income (typically 45%). Where a carry recipient is a UK employee of the fund house and takes customary UK tax-planning steps, there are typically no qualifying conditions to such tax treatment. Furthermore, non-UK residents are not typically subject to UK tax on their carried interest. This is, potentially, all about to change under the new regime.

The core change under the new rules is that, rather than being taxed as profits arising from investment activity, at rates that are based on the underlying proceeds, carried interest will be taxed as profits arising from trading activity and thus will be within the income tax regime and subject to Class 4 National Insurance Contributions (“NICs”), which are generally imposed on the self-employed. Employer NICs will not be due. Under these new rules, carry would be taxed at 45% for additional rate taxpayers with a further 2% NICs, taking the overall top rate to 47%. However, “qualifying” carried interest will be eligible for a partial tax exemption, meaning that only 72.5% of it will be taxable, resulting in an effective tax rate of just over 34%.

“Qualifying” Carried Interest

“Qualifying” carried interest (“QCI”) is to be determined by reference to average holding period rules based on those used in the existing income based carried interest (“IBCI”) regime. In short, if a fund holds its investments, on average, for more than 40 months, the carried interest is QCI.

Significantly, by using an amended form of the IBCI average holding period rules to determine QCI, the new regime will require fund houses to consider the average holding period rules, which are summarised below, in many cases for the first time. Under current law, the IBCI rules only apply to UK resident non-employees (such as LLP members) to determine whether their carry is eligible for taxation as investment profits (rather than trading profits under the disguised investment management fee (“DIMF”) rules).

At the time of the Autumn Budget in 2024, the Government had consulted on adding two potential further requirements before carry can be regarded as “qualifying”—a minimum co-investment amount and a minimum carried interest holding period. Following a recent announcement by the Government, these requirements have been dropped and do not feature in the draft legislation.

IBCI and QCI Average Holding Period Rules: An Overview

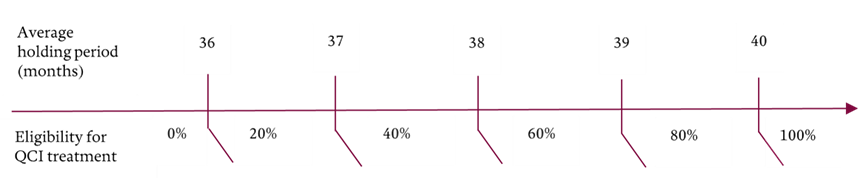

Similarly to the current IBCI rules, the QCI rules provide that if a fund’s average holding period is greater than 40 months, the carried interest is QCI, with a sliding scale if the average holding period is between 36 and 40 months, as illustrated below.

Navigating these rules is not straightforward. The basic calculation of a fund’s average holding period is a weighted average that take into account the value of investments, designed to prevent funds from making one or two very small, long-term investments to circumvent the rules. Since carry frequently arises prior to the disposal by a fund of its final investments (and, therefore, before the fund’s average holding period can be finally determined), the rules effectively require taxpayers to estimate the likely holding periods of unrealised investments, on a “reasonable to suppose” basis, where they receive interim distributions of carry. Special provisions apply to different fund strategies, such as fund of funds, real estate and credit funds, which are intended to take into account differences in the making, holding and disposing of investments and enable the fair application of the average holding period rules but can be complicated to use in practice. For those unaccustomed to addressing IBCI, there will be much to consider in applying the new QCI average holding period rules.

“IBCI Improvements” in the Draft Legislation

Helpfully, the draft legislation has attempted to address some of the more significant issues with the existing IBCI average holding period rules, principally relating to their operation in relation to fund of funds and credit strategies. In particular, the existing rules effectively presume that carried interest arising from certain credit funds is DIMF (subject to limited exceptions). The draft legislation would change the IBCI rules so that credit funds are treated more similarly to other strategies, which should mean that carry arising from them is more likely to be treated as QCI. In relation to funds of funds, the new rules favourably combine the previously separate gateway provisions for “fund of funds” and “secondaries” strategies, since these strategies often overlap. However, it remains unclear whether this new fund of funds gateway provision will fit with the commercial operation of such funds, which may complicate their ability to achieve QCI treatment.

International Issues

International issues represent one of the most important challenges of the proposed carried interest reform, as non-UK residents may be brought within the charge to UK tax on their carried interest if they have worked in the United Kingdom for a fund house any time after October 2024. Under the new regime, these non-UK residents will be deemed to be engaged in a trade in the United Kingdom, and their carried interest will be taxed as trading profits, subject to certain exceptions (in the case of “qualifying” carried interest) for individuals who have performed only limited work in the United Kingdom in recent years. Treaty protection may be available to mitigate such UK tax.

Steps for Determining Taxation of Non-UK Resident Carry Distributions

There are three main steps to determine whether a non-UK resident’s carry distributions may be subject to UK tax in any given UK tax year (from 2026/27 onwards).

Step 1. Take the individual’s “UK workdays” for their fund house (meaning any day in which they perform more than three hours’ work in the United Kingdom) in that year and prior years.

Step 2. Where the carry in question is QCI, the draft legislation provides that UK workdays falling in the following periods are to be treated as non-UK workdays:

- UK workdays prior to October 30, 2024 (i.e. the date of the Autumn Budget);

- UK workdays that fall in a tax year in which the individual was non-UK resident and had fewer than 60 UK workdays (a “non-UK year”); and

- If the individual has had three or more consecutive non-UK years, any UK workdays occurring prior to those years.

Step 3. After applying the above limitations on UK workdays (if applicable), carry attributable to the remaining UK workdays (as a proportion of all workdays for the fund house over the relevant period) is subject to UK tax.

The effect of the “Step 2” limitations is to (very significantly) limit the extraterritorial effect of the new carry regime for individuals who have recently left the United Kingdom (as long as their carry is QCII). It is unclear why HMRC have decided that these limitations should not apply to carry that is not QCI. Non-UK resident carry recipients in that position are left potentially more exposed to UK tax as a result and should consider monitoring their UK workdays.

Effect of Tax Treaties

Even where the new carry regime purports to make non-UK residents’ carried interest subject to UK tax, it is currently unclear whether HMRC would be successful in assessing an individual to tax if they are resident in a jurisdiction that has a double tax treaty with the United Kingdom. The position for any non-UK resident who is potentially caught by the extraterritorial effect of these rules will require careful analysis on a case-by-case basis.

Interaction with FIG Regime

A residence-based, foreign income and gains (“FIG”) regime applies to individuals who become resident in the United Kingdom for the first time (or after a long period of absence), for the first four years of their UK residence, in relation to the taxation of their non-UK source income and gains. (This regime replaced the “remittance basis” regime for UK resident, non-UK domiciled individuals in relation to non-UK source income and gains, with effect from April 2025.) For UK-resident carry recipients who are eligible for the FIG regime, carry that is QCI relating to non-UK services should fall outside the remit of UK taxation, but non-QCI carry will only escape UK taxation if it relates to services that predate the individual’s “arrival” in the United Kingdom.

Payments on Account

A significant cash flow implication of the new regime is that carry recipients are likely to need to make, in each tax year, advance payments on account (“PoAs”) of their next year’s carried interest tax liability based on their prior year’s carried interest (and other income). PoAs apply to individuals for whom less than 80% of their total income tax and Class 4 NICs liability (i.e. excluding capital gains tax) is withheld at source.

Currently, many UK employees of fund houses are not required to make PoAs because their salaries and bonus are subject to tax and NICs withholding at source (under PAYE), and their carried interest returns comprise, to a significant extent, capital gains. So, typically, less than 20% of their overall income falls outside of a withholding-at-source regime. And, while members of fund house LLPs will be more familiar with PoAs, since their LLP profit-share typically falls entirely outside of any withholding-at-source regime, they may not currently factor their carried interest into the PoA calculation if it generally comprises capital gains.

Carry recipients, and the fund houses that provide them with financial information and a degree of tax coordination, may find it more challenging to manage PoAs that are based on the prior year’s income where it includes carry, which is an inconsistent, often unpredictable source of income. While taxpayers can request adjustments from HMRC to the amount of a PoA (e.g. if they think that they will receive significantly less carry the following year), they may suffer a punitive rate of interest if they make a reduction that turns out to have been excessive, which means that carry recipients will need to approach PoA adjustments with caution.

Interaction with Existing UK Carried Interest Tax Regimes

In addition to making the fundamental changes described above, the draft legislation also makes several smaller changes to other elements of current UK law relating to the taxation of carried interest, co-investment and managements fees. However, the position of external investors should not be impacted.

It is important to be aware that the employment-related securities (“ERS”) regime will continue to operate as normal in relation to carry. This means that otherwise “qualifying” carry may nonetheless be treated as employment income absent appropriate steps.

In light of the extensive nature of the draft legislation and the several amendments that it makes to the existing regime, it appears likely that the full implications of the draft legislation will only become apparent following further reflection and engagement with HMRC. We will continue to monitor developments in this area and intend to play an active role in the next phase of the consultation process, which runs to September 15, 2025.

This publication is for general information purposes only. It is not intended to provide, nor is it to be used as, a substitute for legal advice. In some jurisdictions it may be considered attorney advertising.