Consequences of a Federal Government Shutdown

On October 1, 2025, following Congress’ failure to pass an appropriations bill to continue government funding, the federal government shut down. The SEC’s operations will be limited during the government shutdown, as described in the SEC’s operations plan, dated August 7, 2025, and the SEC’s guidance last updated on September 30, 2025.

Effective as of October 1, 2025 and until further notice, the SEC is operating with very limited staff, who are available to respond to emergency situations with a focus on market integrity and investor protections. The SEC plan additionally calls for continuing operations of certain SEC systems such as EDGAR. Registrants will continue to be able to submit filings, but the SEC will not process filings that require staff review or other action. IARD will accept annual and other amendments to Form ADV, Form ADV-W and Form ADV-E filings. However, the SEC staff will be unable to approve applications for registration by investment advisers or give interpretive advice regarding the Investment Advisers Act of 1940 (the “Advisers Act”) and related regulations. No new or pending investment adviser registration applications will be processed during the shutdown. In addition, the staff of the SEC will not respond to requests for written or oral guidance on interpretive or legal questions, including no-action requests. Further, the Division of Investment Management will be unable to consider applications for exemptive relief under the Advisers Act. The shutdown does not suspend regular SEC filing deadlines, such as for Forms 8-K, 10-Q and 10-K, and registrants must continue to comply with such deadlines.

For more information on specific SEC functions and the actions filers are allowed to take during the shutdown, including with respect to registration statements and proxy statements, see Debevoise In Depth.

SEC Signals Support for Shift to Semiannual Reporting

SEC Chairman Paul Atkins has announced support for a shift from the current quarterly reporting regime to semiannual reporting for United States public companies, in line with other jurisdictions including the United Kingdom and European Union. In the United States, the current periodic reporting regime, which requires that public companies disclose their financial results and certain other matters on Form 10-Q each fiscal quarter, has been in place since 1970. The move from quarterly to semiannual reporting thus would be a significant shift in a regime that has been a fixture of the public U.S. capital markets for over half a century.

A move from quarterly to semiannual reporting would have numerous potential implications, including, among others, an emphasis on long-term focus for reporting companies, a reduction in regulation and a decrease in transparency, quality and availability of information available to investors. Even if not required, issuers may continue to voluntarily report quarterly financial and other information, as is common in the United Kingdom and the European Union.

According to Chairman Atkins, the SEC will seek to implement the change through its regular way rulemaking process. The changes may be proposed in the SEC’s “Rationalization of Disclosure Practices” proposal listed in its regulatory agenda, with a target proposal date of April 2026.

For more information, see Debevoise Update.

ExxonMobil’s New Retail Voting Program Demonstrates Significant Structural Innovations in Proxy Contest Mechanics

Background and Strategic Implications for Market Participants. On September 15, 2025, the staff of the SEC’s Division of Corporation Finance granted no-action relief to ExxonMobil’s retail voting program. Under the program, ExxonMobil’s retail shareholders will have the opportunity to provide a standing voting instruction authorizing ExxonMobil to vote their shares based on the recommendations of the company’s board of directors. Shareholders can decide whether the standing instruction will be applicable to all matters, or to all matters except contested director elections and any extraordinary transactions that require a shareholder vote under applicable law (such as mergers). Shareholders will be able to opt out at any time for future meetings and can override the standing instruction for a particular proposal.

For management teams, the program offers a tool to transform latent retail support into active voting power. The ability to mobilize retail shareholders who have traditionally abstained from voting due to complexity or lack of interest, rather than opposition to management, could prove decisive in close contests. It will also help companies achieve quorums at shareholder meetings, as well as obtain votes requiring a majority of outstanding shares, such as amendments to the certificate of incorporation.

Activists will need to reconsider campaign economics and timing in light of these programs and may face uphill battles to persuade retail shareholders to override their voting instructions, adding cost and complexity to activist campaigns. As a result, the retail voting programs may influence which companies are targeted for activism.

Legal Framework and Enforcement Mechanisms. Retail voting programs may be challenged under state corporate law. Such challenges might result from company actions that create impediments to de-enrollment, vote overrides or changes to instructions or from company disclosures in connection with the program or its administration.

The SEC staff’s indication that the ExxonMobil framework may be used by any public company, without the need for individual no-action relief, creates a pathway for rapid proliferation of these programs, particularly among companies with substantial retail ownership.

The no-action relief granted to ExxonMobil excludes registered investment advisers exercising voting authority with respect to client securities from participation. This exclusion, while addressing potential conflicts of interest, creates an interesting dynamic. Many retail investors hold shares through managed accounts or advisory relationships, limiting the universe of eligible participants. This structural limitation may provide a natural ceiling on the program’s impact, though the precise magnitude of this constraint remains unclear.

This development could catalyze a broader reconsideration of retail shareholder engagement. If enrollment rates prove substantial, we may see innovations in how companies encourage retail share ownership and how they communicate with retail shareholders, how activists approach retail-heavy companies and how proxy advisory firms evaluate contests where significant portions of shares are pre-committed. The traditional focus on institutional investors, while still paramount, may need to be balanced with renewed attention to retail shareholders as active participants rather than passive bystanders.

For more information, see Debevoise Update.

SEC Issues Policy Statement Concerning Mandatory Arbitration Provisions

On September 17, 2025, the SEC issued a policy statement (the “Statement”) concerning the presence of mandatory arbitration provisions in issuer governance documents in connection with requests to accelerate the effectiveness of registration statements. As set out in the Statement, the SEC’s position is now that provisions requiring arbitration of investor claims arising under federal securities laws will not impact the SEC’s decision as to whether to declare a registration statement effective, representing a reversal of its prior policy position. Instead, the Statement emphasizes that the SEC’s primary role is evaluating the adequacy of disclosure, including with respect to such provisions. Whether issuers will adopt mandatory arbitration provisions will depend upon various factors, including restrictions under applicable state law, questions of enforceability generally and adverse stockholder and proxy advisor reactions.

Prior to the Statement, the SEC’s position was that mandatory arbitration provisions were inconsistent with the public interest, protection of investors and the anti-waiver provisions of Section 14 of the Securities Act of 1933, as amended. Consequently, the staff of the SEC would not declare a registration statement effective if such a provision were included in an issuer’s governing documents.

For more details, see Debevoise Debrief and the full Policy Statement.

Insights from the September Investor Advisory Committee Meeting

The Investor Advisory Committee (the “IAC”) met with SEC staff to discuss its recommendations for a recalibration of the current regulatory framework such that retail investors can gain access to private market assets. The IAC proposes updates to the SEC interpretations or rules under the Investment Company Act of 1940 to facilitate the ability of registered funds, in which retail investors may invest, to participate in private markets. The IAC also proposed enhanced disclosures and additional investor protections if the SEC were to permit the increased participation of retail investors.

Chairman Atkins suggested the SEC is looking into how it can allow individual investors to participate in private markets but emphasized the need for the “appropriate guardrails” in order to do so.

SEC Clarifies Pro Forma Update Requirements in Discussion with the Center for Audit Quality

The SEC Regulations Committee at the Center for Audit Quality (the “CAQ”) shared a report from its June 26, 2025 joint meeting with staff of the SEC’s Division of Corporation Finance and Office of the Chief Accountant.

At the meeting, the CAQ and SEC staff discussed pro forma financial requirements in filings made after a registration statement becomes effective. In de-SPAC transactions, or where a public shell company acquires a private operating company, registrants must provide pro forma financial information in a proxy or registration statement that reflects the acquisition in a proxy or registration statement. Following effectiveness, certain subsequent filings, such as a Form 8-K reporting the transaction (a “Super Form 8-K”) or future registration statements, may require the registrant to update its and the target entity’s financial statements in compliance with the applicable Regulation S-X age of financial statement requirements.

The CAQ asked the SEC staff whether pro forma financial information reflecting the acquisition should be updated for the latest reporting periods in the Super Form 8-K or subsequent registration statements, even where the registrant does not believe these updates are material. The SEC staff clarified that, where a registrant’s financial statements are required to be updated, the pro forma financial information must also be updated, regardless of any materiality assessment.

The CAQ also asked the SEC staff whether pro forma financial information presented for transactions other than those already discussed (i.e., transactions enumerated in Rule 11-1 of Regulation S-X) must similarly be updated when the financial statements used to prepare the pro forma financial statements are required to be updated. The SEC staff again confirmed that the pro forma financial information would also have to be updated in these contexts, regardless of any materiality assessment.

The CAQ’s next meeting with the SEC staff is scheduled for October 22, 2025.

The Return of Pre-Capitalized Trust Securities as Contingent Financing

Following a multi-year hiatus, we have observed a recent resurgence in pre-capitalized trust securities (“PCAPs”) transactions as interest rates have declined and remained stable. For example, in a first-of-its-kind transaction, Mexico was the first sovereign to issue PCAPs to recapitalize Petróleos Mexicanos, or Pemex, using U.S. Treasury collateral to avoid having to resort to a sovereign debt issuance as a source of rescue capital. The resurgent popularity of PCAPs is in large part due to the flexibility the contingent nature of the financing structure provides, particularly in light of increased economic uncertainty and the desire to have ready funds for acquisitions, debt refinancings or other corporate imperatives. While the PCAPs structure was originally considered contingent capital of last resort, market perception has shifted, and any stigma once associated with draws under these facilities has fallen away. One of the key benefits of PCAPs is that PCAPs are leverage neutral day one and are generally viewed positively by rating agencies.

For more information, see Debevoise Update.

Considerations for Private Equity Sponsors Evaluating Take-Private Transactions

Over the past several years, private equity sponsors have increasingly pursued take-private transactions. At the same time, the SEC has continued to focus on Schedule 13D amendments made by private equity sponsors in connection with such transactions. Failure to timely amend a Schedule 13D can result in cease-and-desist proceedings or enforcement actions. Alternatively (or sometimes, in addition), the SEC may issue a comment letter questioning the timing and contents of a private equity sponsor’s Schedule 13D. Such back and forth with the SEC can, among other things, have the effect of delaying the completion of a transaction by delaying the target’s stockholder meeting to approve the transaction.

For an overview of the Schedule 13D rules and a discussion of considerations related to Schedule 13D amendments that should be top of mind when considering a take-private transaction; see Debevoise In Depth.

CARB Publishes Preliminary List of Covered Entities Under the California Climate Disclosure Laws

The California Air Resources Board (“CARB”) published a preliminary list of covered entities under the Climate Corporate Data Accountability Act (“SB 253”) and the Climate-Related Financial Risk Act (“SB 261”).

The preliminary list was pulled from a California Secretary of State (“SoS”) database and is comprised of United States-based entities doing business in California who meet SB 261’s annual revenue threshold of at least $500 million. The SoS dataset only lists active filers through March 2022 and does not reflect all potential reporting exemptions. CARB’s intention in publishing the preliminary list is to support the development of the fee regulation associated with upcoming reporting requirements. Although the list may be helpful for entities seeking to determine whether they are subject to SB 253 or SB 261’s reporting requirements, the list may not include all covered entities. As noted by CARB, each potentially regulated entity remains responsible for compliance with statutory requirements, regardless of its inclusion in CARB’s preliminary list or outreach.

For more details, see Debevoise Debrief. For more on California’s Climate Disclosure Laws, see Debevoise Update, Debevoise Debrief on the August CARB workshop and Debevoise Debrief on Draft SB 261 Guidance.

An Assessment of the First Issuances Under the EU Green Bonds Regulation

The European Union’s Green Bonds Regulation ((EU) 2023/2631) (the “Regulation”) is a voluntary standard for bonds that wish to use the designation “European Green Bond” or “EuGB.” The Regulation sets out eligibility criteria for investing bond proceeds in environmentally sustainable projects. Issuers are required to publish a prospectus for the offering of EuGB bonds under the EU Prospectus Regulation, requiring review and approval by the state competent authority. The Regulation also sets out requirements for alignment with the EU Taxonomy Regulation, eligibility criteria for investing the proceeds of bonds in environmentally sustainable projects, standards for pre-issuance and post-issuance sustainability reporting and a new framework for external review of those reports and supervision of the reviewers.

The Regulation has been in place since December 2024. Since then, 11 offerings have been conducted under this regime, ranging from €20 million to €3 billion, by regional authorities, a sovereign nation and companies in the finance, real estate and utilities sectors, most of which had previously issued traditional ESG bonds. While use of the EuGB regime has been limited when compared to traditional ESG- or sustainability-linked financings, the initial offerings provide valuable insights as to how potential issuers may consider approaches and use cases, particularly on the following topics: allocation of proceeds, use of proceeds, environmental disclosures, issuance costs, noteholder remedies and the optional disclosure regime.

For more information, see Debevoise In Depth and for more background on the Regulation, see Debevoise In Depth.

Select Recent Securities Law Legislation Proposals

A summary of selected recent securities law-related legislation proposed in September 2025 follows.

|

Proposed Legislation

|

|

Name of Bill

|

Description of Bill

|

Latest Action

|

|

S.2924

|

To require the SEC to carry out a study and rulemaking on the definition of the term “small entity” under the securities laws for purposes of chapter 6 of title 5, United States Code, and for other purposes.

|

Senate - 09/29/2025 Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

|

|

S.2920

|

To enhance civil penalties under the Federal securities laws and for other purposes.

|

Senate - 09/19/2025 Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

|

|

S.2919

|

To amend the Sarbanes-Oxley Act of 2002 to promote transparency by permitting the Public Company Accounting Oversight Board to allow its disciplinary proceedings to be open to the public and for other purposes.

|

Senate - 09/19/2025 Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

|

|

S.2906

|

To amend the Investment Company Act of 1940 to address entities that are not considered to be investment companies for the purposes of that Act and for other purposes.

|

Senate - 09/18/2025 Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

|

|

S.2840

|

To amend the Investment Company Act of 1940 to postpone the date of payment or satisfaction upon redemption of certain securities in the case of the financial exploitation of specified adults and for other purposes.

|

Senate - 09/17/2025 Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

|

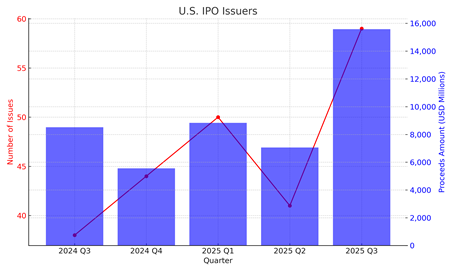

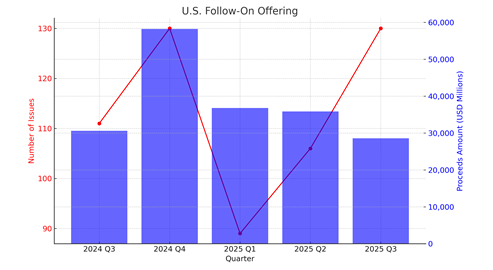

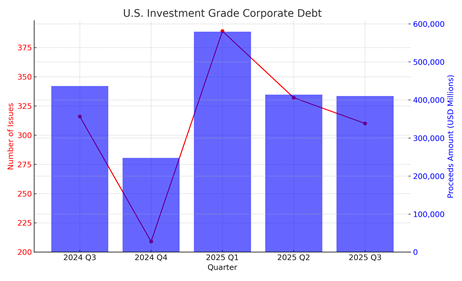

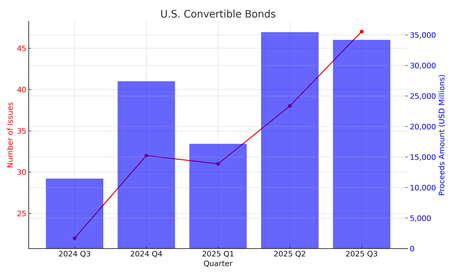

Markets At a Glance

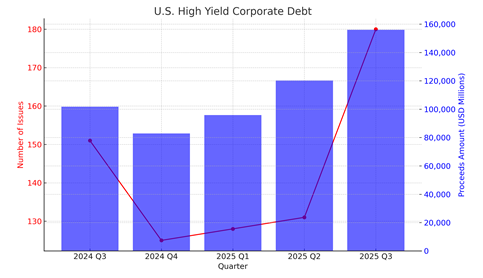

The below market snapshot shows the volume of U.S. IPOs, follow-on offerings, investment grade corporate debt issuances, convertible bonds issuances and high-yield corporate debt issuances from the third quarter of 2024 through the third quarter of 2025.

This publication is for general information purposes only. It is not intended to provide, nor is it to be used as, a substitute for legal advice. In some jurisdictions it may be considered attorney advertising.