Public Company Outlook for 2026

As we turn the calendar to 2026, public companies face an evolving set of legal and market dynamics that will shape governance, transactions and engagement with stockholders. Several key areas for consideration include:

- Alternatives to Incorporation in Delaware: In response to several court decisions that upheld challenges to transactions involving controlling stockholders, some companies are considering incorporating outside of Delaware into jurisdictions such as Nevada and Texas though actual reincorporations remain limited. Open questions include the effect of recent Delaware legislation intended to address some of the concerns about Delaware fiduciary duty litigation, including litigation relating to controlling stockholders, as well as the evolving attitude of institutional investors toward reincorporation proposals or initial public offerings (“IPOs”) outside of Delaware.

- S.B. 21: In March 2025, Delaware enacted S.B. 21 amending the Delaware General Corporation Law in an attempt to clarify and streamline approval of transactions involving conflicted directors or controlling stockholders and to constrain the scope of materials available pursuant to stockholder books-and-records demands. While S.B. 21 is expected to promote more efficient dealmaking by providing a clearer framework for avoiding protracted deal litigation, it will not eliminate stockholder litigation over conflicted and controller transactions. As more conflicted and controller transactions are completed in reliance on the safe harbors provided in S.B. 21, we expect aspects of the statute and transactions structured under it to be challenged in litigation in 2026.

- Shareholder Activism: M&A deal volume and activist activity have steadily increased over the past several years toward pre-COVID levels and both metrics are expected to remain elevated in 2026, as a robust M&A market creates fertile ground for activism. Activists are also increasingly securing board representation through faster and more frequent settlements, a trend accelerated by universal proxy rules. M&A deal volume and activist campaigns are expected to increase in 2026.

- Proxy Advisory Firms: While President Trump recently issued an executive order targeting Institutional Shareholder Services (“ISS”) and Glass, Lewis & Co. (“Glass Lewis”) with the stated purpose of increasing oversight and restoring confidence in the proxy advisory industry, proxy advisors are expected to remain highly influential in 2026 due to a lack of practical alternatives for institutional voting analysis. Pass-through voting and retail voting programs have emerged in recent months as voting alternatives. While pass-through voting (which allows fund investors to convey their vote preferences without the need to create a separate account or a new fund, with the fund voting its shares in proportion with those preferences) is not expected to have a significant impact on the outcome of stockholder meetings, retail voting programs (which allow individual companies to enroll retail stockholders in programs that allow stockholders to provide standing voting instructions aligned with management recommendations) are likely to see increased adoption after the 2026 proxy season. For more information, see “Executive Order Targets Proxy Advisors and Shareholder Proposals” below.

- U.S. Antitrust Enforcement: The merger control environment in the United States is expected to remain relatively deal-friendly. The return of remedies being available as a means to address competition issues raised by transactions continues to provide regulators and companies a relief valve, assuming an acceptable remedy package can be developed and implemented. Still, regulators continue to carefully scrutinize transactions that raise competition concerns. Outside the United States, regulators have not necessarily adopted the same transaction-friendly approach. As a result, multi-national transactions will continue to face antitrust hurdles.

- Global Minimum Tax Regimes: Following the enactment of U.S. tax legislation in 2025, attention is expected to center on implementing the G7’s “side-by-side” framework aligning U.S. tax rules with the “Pillar 2” global minimum tax regime of the Organisation for Economic Co-operation and Development’s (the “OECD”), following new OECD guidance that largely exempts U.S.-parented multinationals from Pillar 2. While this reduces immediate cross-border tax friction, significant complexity remains for non-U.S.-parented groups and future political tensions could revive threats such as a U.S. “revenge tax.”

- Artificial Intelligence: The increased use of AI across a range of functions in many public companies has raised attendant risks for those companies including business risk, regulatory risk, technological risk, cybersecurity risk and governance risk. The use of AI in a company’s core business functions also raises oversight issues. As more public companies are considering implementing policies governing the use of AI by their employees and implementing guardrails to ensure best practices in the use of AI tools, AI governance will continue to be an important topic in 2026 and beyond.

- Private Equity in Public Company M&A: While private equity transactions involving public companies raise challenging issues as to economic rights, governance and exit, private equity sponsors are expected to remain active in public company M&A in 2026. The increase in private equity sponsors pursuing take-private transactions has largely been driven by market volatility, perceived public market undervaluation of certain public companies relative to their long-term prospects, the rise of private debt financing to finance these deals and the perceived unattractiveness of continuing as a publicly traded company.

- Executive Compensation: In June 2025, the SEC convened a public roundtable to assess whether the current executive compensation disclosure regime continues to provide investors with clear, decision-useful information. While the timing of any potential reforms remains uncertain and will not affect the 2026 reporting season, the SEC is expected to address executive compensation disclosures in 2026.

For more information, see Debevoise in Depth.

Key Considerations for the 2025 Annual Reporting Season

As the annual reporting season approaches, public companies must navigate a wide range of actively developing disclosure considerations when filing their annual reports on Form 10-K or Form 20-F for the 2025 fiscal year. While the SEC was not particularly active in advancing new rulemaking in 2025, public companies must still navigate a range of developing disclosure considerations. Below are a few key considerations:

- Artificial Intelligence: We expect the SEC to continue to focus on AI, particularly on “AI-washing”—hyperbolic or inaccurate AI disclosures—which may lead to fraud claims under the federal securities laws. Public companies should closely scrutinize all public- and investor-facing materials to ensure that any representations about the use of technology, automation or AI are accurate and substantiated. AI is also a top priority in the SEC’s Division of Examinations 2026 Examination Priorities, with examiners assessing whether companies’ disclosures, controls and governance align with actual AI practices. Recent SEC comment letters underscore the SEC’s view that companies should avoid suggesting that their AI technologies are more autonomous, scalable or commercially mature than they actually are. The SEC has emphasized that accurate AI disclosure requires not only describing current uses but also addressing material risks—including data quality issues, model limitations, cybersecurity considerations and potential bias or compliance concerns. While SEC leadership has indicated that new, prescriptive AI disclosure rules are unnecessary, companies remain responsible under existing principles-based requirements to disclose material AI-related impacts and risks accurately. For future updates on developments relating to AI, see Debevoise Data Blog – Artificial Intelligence.

- Insider Trading Policies: Item 601 of Regulation S-K requires public companies to include any insider trading policy as an exhibit to their Form 10-K or Form 20-F. In addition, Item 408(b) of Regulation S-K and Item 16J of Form 20-F require companies to disclose whether they have adopted insider trading policies and procedures covering trading in the company’s securities by employees, officers, directors and, if applicable, the company itself, that are reasonably designed to ensure compliance with insider trading laws, regulations and listing standards (and if not, why not). A company can incorporate by reference in its Form 10-K the information required under Item 408(b) from a definitive proxy statement if the proxy statement is filed within 120 days of the end of the fiscal year. For more information regarding the content of insider trading policies filed during the 2024 annual reporting season, see this Debevoise Special Issue.

- Cybersecurity: Item 106 of Regulation S-K requires public companies to describe their process for assessing, identifying and managing material risks from cybersecurity threats as well as the board’s oversight of, and management’s role and expertise in, assessing and managing material risks posed by cybersecurity threats. While the SEC has issued relatively few comment letters on these disclosures to date, it has flagged complete omissions of Item 1C disclosure and, in particular, insufficient descriptions of management expertise, emphasizing that companies should address not only the Chief Information Security Officer but also other key information security personnel. Although industry groups have petitioned the SEC to rescind certain incident reporting requirements under Form 8-K and Form 6-K, the SEC has not indicated an intent to revisit Item 106, and cybersecurity remains a top priority in the Division of Examinations’ 2026 priorities, with a focus on governance, vendor oversight, access controls, incident response and resilience in light of evolving cyber and AI-related threats.

For analysis of additional disclosure considerations and important information related to filing procedures and upcoming deadlines, see Debevoise in Depth.

Key Considerations for the 2026 Proxy Season

When preparing for the 2026 proxy season, public companies should review proxy advisor policy changes, shareholder proposals and engagement strategies, among other factors. Some key takeaways for this year’s proxy season include:

- The 2026 proxy season may be less predictable as proxy advisor policy changes, evolving Rule 14a-8 processes and shifts in investor stewardship are likely to affect shareholder engagement, voting dynamics and disclosure expectations. ISS is moving away from a presumptive “vote for” for environmental and social shareholder proposals in favor of a case-by-case approach, tightening its stance on unequal voting rights and refining its executive compensation analyses. Glass Lewis has updated its policies to focus on heightened scrutiny of mandatory arbitration provisions and shareholder-rights limitations, a new scorecard-based pay-for-performance methodology and a case-by-case approach to governance document amendments. For more information, see “Policy Updates from ISS and Glass Lewis” below.

- Companies should review shareholder proposal and engagement strategies in light of the SEC’s decision not to substantively respond to most Rule 14a-8 no-action requests and the potential litigation, reputational and activism risks associated with excluding proposals without no-action relief. In addition, following the SEC’s guidance addressing the circumstances in which a shareholder’s engagement with a company’s management would cause the shareholder to be deemed to hold the subject securities with the “purpose or effect of changing or influencing control of the issuer,” many institutional investors have adjusted their shareholder‑engagement practices. Some have ended proactive outreach and will meet only at a company’s request; others have adopted a listen‑only posture or limited participation to discussions the company initiates or clearly frames. More broadly, investors are opening meetings with disclaimers emphasizing that they are not exercising control and are less willing to preview voting intentions. Further refinements to these approach are expected over the coming proxy season.

- Companies should revisit their proxy disclosures with a “2026 lens” to ensure transparent and updated disclosures that align with shifting investor and proxy advisor expectations in order to sharpen shareholder engagement strategies, enhance governance and compensation disclosures and prepare for a more complex, less predictable proxy environment in 2026 and beyond.

For more information, see Debevoise in Depth.

2026 Executive Compensation Reminders for Public Companies

As the new SEC rulemaking landscape shifts, companies and compensation committees should monitor ongoing developments regarding executive compensation disclosure rules and other related regulatory updates. A few suggested best practices for companies include:

- Monitor Ongoing Developments on Executive Compensation Disclosure Rules: In June 2025, the SEC convened a public roundtable to assess whether the current executive compensation disclosure regime continues to provide investors with clear, decision-useful information. While the timing of any potential reforms remains uncertain and will not affect the 2026 reporting season, the SEC is expected to address executive compensation disclosures in 2026.

- Review Executive Security Practices and Related Disclosure Considerations: In the wake of several high-profile security incidents, many public companies have strengthened executive security programs in 2024 and 2025 through expanded residential security, personal security details, cybersecurity protections and enhanced travel protocols. Executive security programs are becoming more common and more costly, and they remain treated as perquisites subject to detailed disclosure under existing SEC rules. To ensure continued compliance, companies should strengthen internal controls for approving and tracking security-related costs and related disclosures.

- Review Proxy Disclosures Around Non-GAAP Measures in Incentive Plans: Although 2025 did not introduce new SEC rules or proxy advisor policies on non-GAAP financial measures, proxy advisors continue to emphasize transparency and robust disclosure of such adjustments, particularly against the backdrop of continued macroeconomic and geopolitical volatility that has made goal setting more challenging for compensation committees. Looking ahead, compensation committees should evaluate strategies to enhance the resilience and durability of incentive plans given the significant volatility experienced in recent years.

- Review 2025 Say-on-Pay Voting Trends Heading into 2026: The 2025 say-on-pay season remained characterized by historically high overall support and low failure rates, albeit with modest softening compared to recent years. Ahead of the 2026 proxy season, companies should analyze 2025 voting results and refine disclosures and engagement ahead of the 2026 season to identify themes that may raise concerns under ISS’s and Glass Lewis’s updated pay-for-performance frameworks.

- Stay Current on Proxy Advisor Firm Developments for the 2026 Season: Both ISS and Glass Lewis made several notable updates to their executive compensation policies for the 2026 proxy season. Although much of each advisor’s overall framework remains consistent with 2025, several targeted methodological changes may affect pay-for-performance outcomes, qualitative assessments and disclosure expectations.

- Ensure Operational Readiness for Potential Clawbacks: Now that listed public companies have adopted Dodd-Frank-mandated clawback policies under the exchange listing standards implementing Exchange Act Rule 10D-1, the focus has turned to operational readiness and administration. Companies should evaluate their compensation programs to determine whether any elements are “incentive-based compensation” within the meaning of their Dodd-Frank clawback policy and applicable exchange rules.

- Evaluate CEO Succession Planning and Related Disclosures: CEO transitions remain an area of significant investor attention and media scrutiny. Elevated CEO turnover has heightened investor expectations around succession planning, transition pay and transparency. Boards should maintain robust succession frameworks and clearly disclose the rationale and structure of transition-related compensation.

- Prepare for Expansion of Section 162(m) Covered Employees in 2027 and the New Aggregation Rule: Under the American Rescue Plan Act of 2021, the expanded definition of covered employees will expand after December 31, 2026 to include additional executives. In addition, the One Big Beautiful Bill Act, enacted in 2025, has introduced an aggregation rule effective for tax years beginning after December 31, 2025. Companies should identify affected employees now and consider structural and timing strategies to manage future tax impacts.

- Monitor Noncompete Developments: Following court decisions in 2024 invalidating the FTC’s nationwide noncompete rule and setting it aside on a nationwide basis, the FTC has withdrawn its appeals and publicly shifted to a case-by-case enforcement strategy. The FTC also stated its intention to pursue “aggressive” enforcement against noncompete practices it views as unfair methods of competition. State noncompete developments also continue to evolve rapidly and inconsistently. As the executive compensation landscape continues to evolve, careful planning, sound governance structures and thoughtful proxy disclosures will help companies meet regulatory, investor and market expectations.

For more information, see Debevoise in Depth.

2026 International Capital Markets Outlook

U.S. capital markets enter 2026 with renewed momentum supported by favorable SEC regulatory developments; the United Kingdom (the “UK”) and European Union (the “EU”) are also introducing active reforms to remain issuer-friendly and attract new listings. In 2025, international capital markets saw strong performance across regions and asset classes, supported by falling interest rates, rising M&A activity and robust demand in AI and cryptocurrency, despite geopolitical and trade uncertainties. U.S. debt and equity markets reached activity levels not seen since 2021, while the UK and EU experienced notable IPOs, leveraged buyouts and sector-specific interest in finance and defense. Looking to 2026, optimism is rising as the SEC has signaled potential easing of compliance and disclosure requirements, and UK and EU regulators have continued to implement reforms to attract and retain listings.

For an in-depth outlook on key regulatory developments expected to impact the international capital markets in 2026, with a specific focus on those that may affect foreign private issuers (“FPIs”) in the U.S. and capital markets in the UK and EU, see Debevoise in Depth.

Section 16(a) Reporting Obligations to Be Extended to Directors and Officers of Foreign Private Issuers

On December 18, 2025, President Trump signed the Fiscal Year 2026 National Defense Authorization Act (the “NDAA”) that, for the first time, would require directors and officers of FPIs with equity securities registered under the Securities Exchange Act of 1934 (the “Exchange Act”) to comply with the insider reporting requirements of Section 16(a) of the Exchange Act. The bill is scheduled to take effect on March 18, 2026, at which point the SEC must issue final regulations to carry out the amendment.

As amended by the NDAA, Section 16(a) would require directors and officers of FPIs with Exchange Act–registered equity securities to publicly report their beneficial ownership and changes in ownership on the SEC’s EDGAR system. Covered “officers” include senior executive and policy-making personnel, and reportable interests extend beyond direct holdings to certain indirect and derivative interests. Insiders must file Form 3 upon becoming subject to reporting, Form 4 within two business days of most transactions and Form 5 annually for certain unreported or exempt transactions. These obligations apply regardless of whether the securities are exchange-listed and may continue for a limited time after an individual ceases to be a director or officer.

SEC Exemptive Authority

The NDAA grants the SEC broad discretion to exempt individuals, securities or transactions from Section 16(a) if a foreign jurisdiction’s laws impose “substantially similar” insider-reporting requirements, though the statute does not define that standard. The SEC must issue implementing rules within 90 days of enactment, creating an accelerated rulemaking process that will largely determine the availability and scope of exemptions. The SEC could apply exemptions on a jurisdiction-by-jurisdiction basis, with potential candidates including established insider reporting regimes in Canada, the EU and the UK.

Directors and Officers

Currently, FPI directors and officers are not subject to Section 16(a) and generally disclose equity ownership only in aggregate on Form 20-F, while significant shareholders report under Section 13. If Section 16(a) becomes applicable, FPIs and their insiders will face substantially increased, individualized and time-sensitive reporting obligations. As a result, FPIs should begin to consider which executives qualify as Section 16 officers, strengthening internal controls for tracking insider transactions and equity awards, deciding on reporting responsibilities and ensuring insiders have EDGAR access to support timely filings.

Next Steps

FPIs and their directors and officers should proactively prepare for compliance with Section 16(a) while closely monitoring the SEC’s forthcoming implementing rules. Those rules will be critical in clarifying reporting mechanics and determining whether and to what extent exemptive relief will be available for foreign jurisdictions. Early planning will help mitigate compliance and enforcement risk once the amendments take effect.

For more information, see Debevoise in Depth.

Policy Updates from ISS and Glass Lewis

In December 2025, ISS and Glass Lewis released updated benchmark voting policies for 2026, including changes related to social and environmental proposals, compensation and shareholder rights. While the changes are relatively modest, these annual policy updates are important for companies to consider in advance of the 2026 proxy season. Both proxy advisory firms are shifting toward more tailored governance practices in response to shareholder concerns. Companies whose largest shareholders are influenced by ISS or Glass Lewis should review these policy changes closely and consider whether to adjust their governance or disclosure practices in accordance with these policies.

ISS’s updated policy, which takes effect for meetings on or after February 1, 2026, includes the following changes:

- Unequal Voting Rights: ISS has clarified that it will recommend against directors at companies with unequal voting rights whether the high-vote shares are classified as “common” or “preferred,” as opposed to the existing policy which only refers to high-vote common stock. The new policy also generally recommends voting against proposals to create a new class of preferred stock with voting rights superior to common stock.

- Environmental and Social (“E&S”) Shareholder Proposal Updates: ISS will now recommend on a case-by-case basis on E&S shareholder proposals related to climate change/greenhouse gas emissions, diversity, human rights and political contributions. Previously, ISS’s policy was to generally recommend “for” such E&S proposals.

- Pay-for-Performance Evaluation: ISS has extended the period over which it will evaluate pay-for-performance quantitative screens from three years to five years. ISS has also extended the evaluation period of a CEO’s total pay relative to the peer group median over one-year and three-year periods instead of only the most recent fiscal year. ISS has also included more flexibility in its qualitative review of the equity pay mix of pay-for-performance policies.

- Equity Plan Scorecard: ISS has added a new scoring factor under the Plan Features pillar of the Equity Plan Scorecard to assess whether a plan in which non-employee directors participate discloses cash-denominated award limits, which ISS views as a best practice. Additionally, to address situations where equity plans receive an overall passing score under the Equity Plan Scorecard but have very weak or zero scores in the Plan Features pillar, ISS is introducing a new negative overriding factor. This will allow ISS to recommend against plans that lack sufficient positive features in the Plan Features pillar, even if they pass overall.

- High Non-Employee Director Pay: ISS will now recommend against directors for approving excessive or problematic non-employee director pay if such pay is deemed egregious, even in the first year, or if there is a pattern of such pay over multiple non-consecutive years. Previously, this policy only applied if excessive pay occurred in two consecutive years.

- Board Responsiveness to Low Say-on-Pay Support: In light of the SEC’s guidance on 13D/G eligibility and its effect on shareholder feedback availability, ISS has updated its board responsiveness policy. Now, when a company’s say-on-pay vote receives less than 70% approval, ISS will focus on whether the company’s actions address the broader interests of shareholders, rather than responding to the feedback of specific shareholders.

Glass Lewis’s updated policy includes the following changes:

- Mandatory Arbitrary Provisions: Glass Lewis will now review mandatory arbitration and other potentially negative governance provisions in governing documents following an IPO, spin-off or direct listing and may recommend opposing the election of the governance committee chair or the entire committee. Glass Lewis will also generally vote against bylaw and charter amendments seeking to adopt mandatory arbitration provisions unless the company provides adequate rationale and disclosure.

- Supermajority Vote Requirements: Glass Lewis will now assess proposals to remove supermajority voting requirements on a case-by-case basis. In cases where a company has a large or controlling shareholder, supermajority requirements may be necessary to protect minority shareholders, and Glass Lewis may oppose their elimination in such situations.

- Shareholder Rights: When a board has amended their company’s governing documents to reduce or eliminate key shareholder rights, Glass Lewis may now consider additional factors and recommend voting against the governance committee chair or the entire committee. Examples include amendments that: (1) restrict the ability of shareholders to submit proposals; (2) limit the ability of shareholders to file derivative lawsuits; or (3) replace majority voting with plurality voting.

- Shareholder Proposals: Due to changes in the SEC’s no-action letter process, specific guidance has been removed. However, Glass Lewis will continue to assume that shareholders should have the opportunity to vote on significant matters. With ongoing changes and potential further adjustments to the shareholder proposal process, Glass Lewis may update its approach before or during the 2026 proxy season.

- Amendments to Bylaws or Charter: Glass Lewis will now evaluate proposed amendments to bylaws or charters on a case-by-case basis. Generally, it will recommend voting for amendments that are unlikely to have a material negative impact on shareholders’ interests. Glass Lewis strongly opposes the practice of bundling several amendments under a single proposal because it prevents shareholders from reviewing each amendment on its own merit.

- Pay-for-Performance Methodology: Instead of assigning a single letter grade from “A” to “F,” Glass Lewis’s model will now use a scorecard approach with up to six criteria. Each criterion will receive a rating, which will be weighted and combined to produce an overall score ranging from 0 to 100.

For more information, see ISS’s updated policy and Glass Lewis’s updated policy.

Executive Order Targets Proxy Advisors and Shareholder Proposals

On December 11, 2025, President Trump signed Executive Order 14366 (the “EO”) entitled “Protecting American Investors From Foreign-Owned and Politically-Motivated Proxy Advisors,” aimed at challenging the role of proxy advisory firms in corporate governance. The EO asserts that proxy advisory firms have used their influence to advance “politically-motivated agendas” focused on diversity, equity and inclusion and environmental, social and governance issues while failing to emphasize investor returns and fiduciary duties. The EO specifically calls for increased scrutiny of ISS and Glass Lewis, two major proxy advisory firms which together comprise a vast majority of the proxy advisory industry and significantly influence institutional voting on corporate governance matters, including shareholder proposals, board compositions and executive compensation.

The EO specifically calls for the SEC to conduct a comprehensive review of all rules, guidance and memoranda related to proxy advisors and shareholder proposals, including Rule 14a-8, and to consider revising or rescinding those that are inconsistent with the EO’s objectives.

SEC Greenlights DTC Securities Tokenization Pilot

On December 11, 2025, the SEC’s Division of Trading and Markets granted the Depository Trust Company’s (“DTC”) request for no-action relief from Regulation Systems Compliance and Integrity (“Reg SCI”) and several other provisions and rules of the Exchange Act, permitting the DTC to launch the pilot version of a securities tokenization program. This program, which is set to launch on supported blockchains, will enable DTC participants to tokenize security entitlements for certain eligible securities. Participants with registered wallets will be able to transfer these tokenized entitlements directly to other participants’ wallets, with DTC’s system tracking all transfers in its official records.

In a follow-up statement, SEC Commissioner Hester M. Peirce explained that while this is a pilot program with operational limitations, it represents a significant step toward bringing securities markets onto blockchain platforms. Peirce also clarified that while the SEC encourages ongoing innovation in this space, varying tokenization models may present distinct regulatory challenges.

For more information, see the No-Action Letter and follow-up SEC Statement.

Nasdaq Implements Stricter Listing Standards for Certain IPOs

On December 12, 2025, Nasdaq proposed a new rule giving the exchange the discretion to refuse an IPO, even if an applicant meets all numerical listing requirements. This rule would allow Nasdaq to deny listings on “qualitative” grounds, such as concerns about stock manipulation, corporate governance issues or potential risks related to the issuer’s jurisdiction and control structures. Factors like the availability of legal remedies for U.S. investors and the influence of controlling parties would also be considered.

The proposed rule highlights increased efforts to tighten listing standards in response to rising concerns about market volatility and manipulation, particularly in cross-border listings from jurisdictions like China. Nasdaq’s move comes amid heightened scrutiny from the SEC and other agencies regarding a surge in “pump-and-dump” schemes aimed at artificially inflating stock prices.

These proposed rule changes come on the heels of a broader effort by Nasdaq, including multiple proposals in September 2025, to implement stricter listing standards and faster delisting processes to address concerns around thinly traded companies, also aimed at combatting pump-and-dump schemes. On December 19, 2025, the SEC approved the proposed rules granting Nasdaq limited discretion to deny initial listing for a company even if it meets Nasdaq’s listing requirements with the new rule to be effective immediately. On December 18, 2025, the SEC requested comments on the proposed rule change due within 21 days from publication.

NYSE Proposes Minimum Share Price Requirement

The New York Stock Exchange (the “NYSE”) has proposed an amendment to Section 802.01C of its Listed Company Manual (the “Manual”), which would establish a minimum trading price requirement for securities to remain listed on the NYSE. The proposed rule change would mandate that if a security’s closing price falls below $0.25 on any trading day, the NYSE would immediately suspend trading and begin delisting procedures. This change aims to protect investors from the risks associated with low-priced stocks, which are more prone to market manipulation and trading volatility. The new proposed rule would take effect on October 1, 2026, giving issuers time to adjust, including through reverse stock splits.

The proposal is designed to eliminate these risks while providing issuers with a transition period. The rule also clarifies that if a security’s price remains below $0.25, it cannot submit a plan to regain compliance. On December 12, 2025, the SEC requested comments on the proposed rule change due within 21 days from publication, and a decision on the rule is expected within 45 to 90 days.

Nasdaq Seeks SEC Approval for 23-Hour, Five-Day Trading Schedule

Nasdaq is seeking regulatory approval to extend its trading hours to 23 hours a day, five days a week, in response to growing demand for overnight access to U.S. stocks, particularly from international investors. Under the proposal, Nasdaq would maintain its current daytime session from 4:00 a.m. to 8:00 p.m. ET and introduce a new overnight “Night Session” from 9:00 p.m. to 4:00 a.m. ET. There would then be a one-hour pause each day for system maintenance and corporate actions.

Under the proposal, overnight trading would be more limited, offering fewer order types and reduced regulatory protections compared with regular market hours. Nasdaq plans to launch the extended hours only once its market data systems are fully equipped to handle overnight trading. Nasdaq emphasized that this move reflects the demand from global investors for more flexible access to markets without compromising trust or market integrity.

Select Recent Securities Law Legislation Proposals

A summary of selected recent securities law-related legislation proposed in December 2025 and January 2026 follows:

|

Proposed Legislation

|

|

Name of Bill

|

Description of Bill

|

Latest Action

|

|

H.R.6541

|

To amend the Securities Act of 1933 with respect to small company capital formation, and for other purposes.

|

House ‒ 12/09/2025

Referred to the House Committee on Financial Services.

|

|

S.3562

|

To require the SEC to amend its rules relating to disclosures by advisers of private funds, and for other purposes.

|

Senate ‒ 12/18/2025

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

|

|

H.R.6967

|

To amend the Securities Exchange Act of 1934 to establish within the SEC the Public Company Advisory Committee, and for other purposes.

|

House ‒ 01/07/2026

Referred to the House Committee on Financial Services.

|

Markets At a Glance

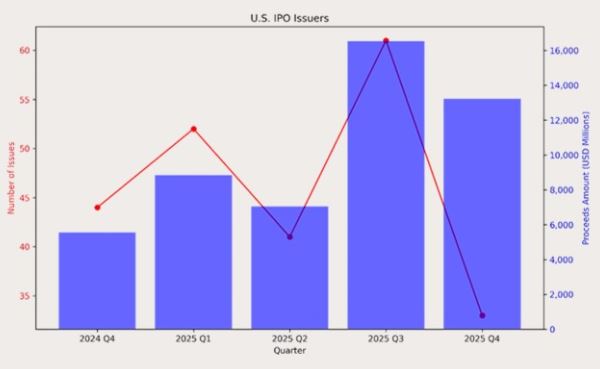

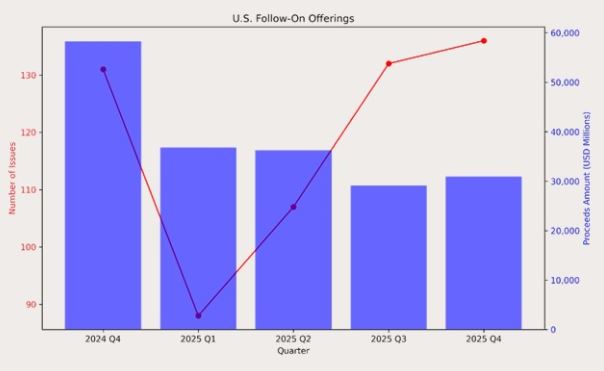

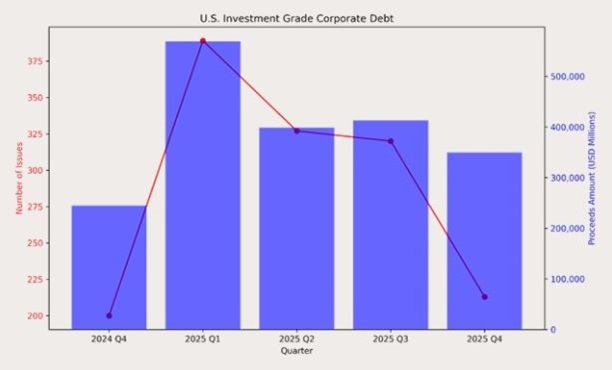

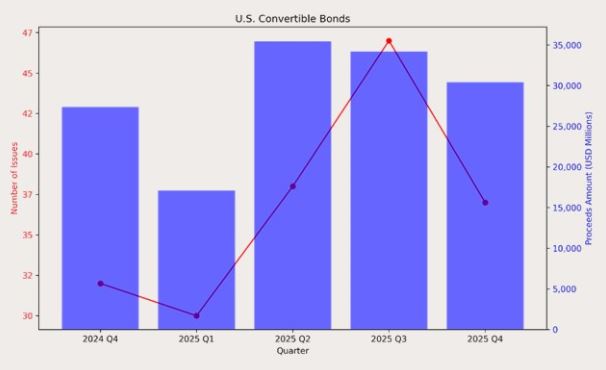

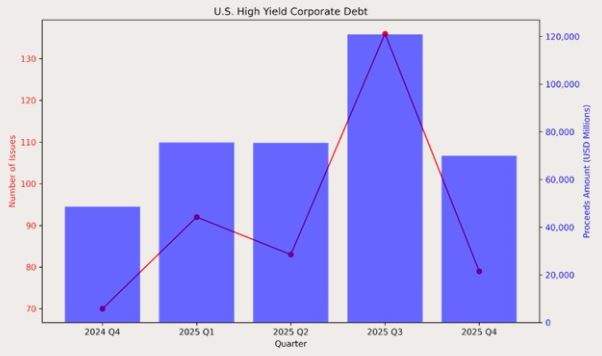

The below market snapshot shows the volume of U.S. IPOs, follow-on offerings, investment grade corporate debt issuances, convertible bonds issuances and high-yield corporate debt issuances from the fourth quarter of 2024 through the fourth quarter of 2025.

This publication is for general information purposes only. It is not intended to provide, nor is it to be used as, a substitute for legal advice. In some jurisdictions it may be considered attorney advertising.