Much ink has been spilled on the increasing number of private equity sponsors

and cash-rich strategics chasing after the same limited pool of quality targets.

Much less attention has been paid to what we see as a growing and important

trend: transactions involving private equity sponsors “teaming up” with strategics

in innovative ways that unlock value for both sides. Recent transactions illustrate

the various forms these partnerships can take:

- The sponsor and the strategic team up to acquire a business, as when

OptumHealth and Summit Partners joined forces to acquire Sound Physicians

or when KKR teamed with HCA Healthcare to acquire Envision Healthcare.

- A strategic sells a stake in an existing business to a sponsor, such as Thomson

Reuters’ sale of its majority stake in its Financial & Risk unit to Blackstone.

- A strategic buys a stake in a sponsor-owned portfolio company, such as

Tenet Healthcare’s acquisition of United Surgical Partners, a portfolio company

of Welsh, Carson, Anderson & Stowe (WCAS).

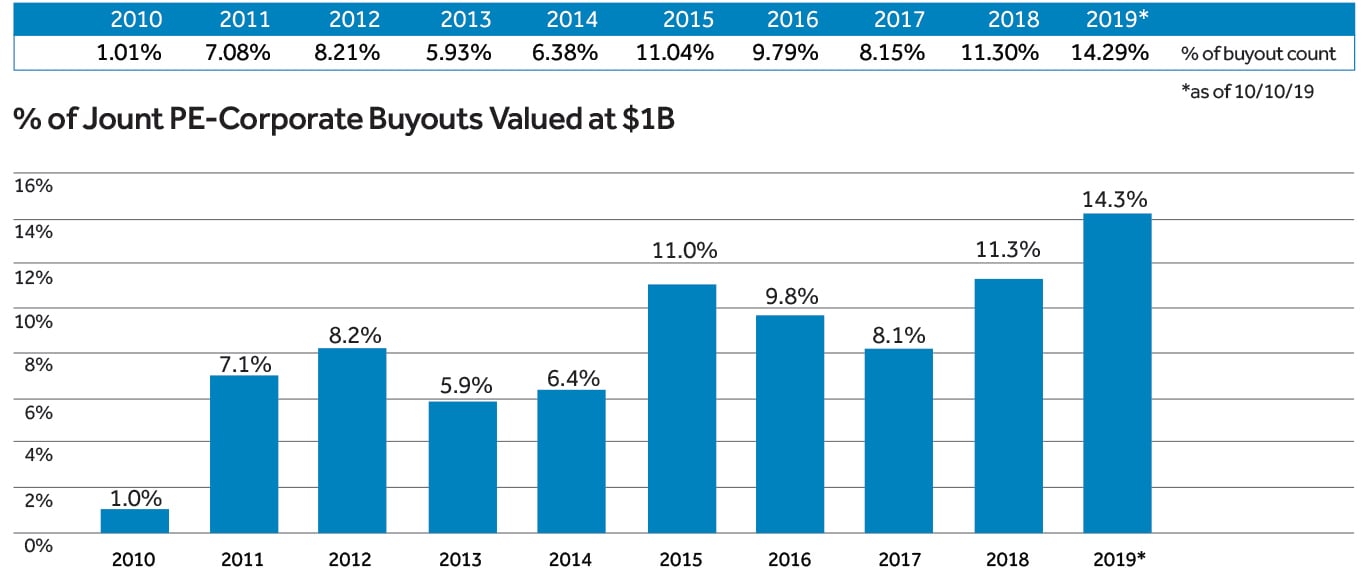

Data from Capital IQ indicates that there were 13 transactions involving some form

of sponsor-strategic partnership out of 43 private equity buyouts with deal values in

excess of $500 million that were announced between January 2017 and September

2019. According to PitchBook, over 10% of private equity buyouts in 2018 with

deal values in excess of $1 billion involved sponsor-strategic partnerships (in 2019

(through the beginning of October), that figure is closer to 15%).

A number of sponsor-strategic

partnership transactions have been

concentrated in the healthcare sector,

where we have seen sponsors leverage

partnerships with corporate buyers

to navigate regulatory requirements

and exploit commercial opportunities.

Indeed, according to the 2019

Bain Global Healthcare Private

Equity Report, in 2018, there were

18 sponsor-strategic partnership

deals in the healthcare sector that

accounted for $7.9 billion, or 12.5% of

disclosed value. Further, KKR/HCA’s

acquisition of Envision Healthcare and

OptumHealth/Summit’s acquisition

of Sound Physicians mentioned above

were among the 10 largest healthcare

deals of 2018.

Advantages of Sponsor-

Strategic Partnerships

From the sponsor’s perspective, partnering

with a strategic to acquire a business offers

a number of important advantages:

The partnership may distinguish

the sponsor in a competitive process

and allow it to tap into synergies

and additional sources of capital to

afford higher valuation multiples and

participate in larger deals

The strategic partner may give the

acquired business access to more

markets, distribution networks,

commercial opportunities and

economies of scale than a sponsor

alone could offer

A strategic partner can help mitigate

concerns that shareholders and

regulators may have regarding a

private equity buyer, particularly in

regulated sectors such as healthcare

and insurance

Alternatively, if a stand-alone

acquisition by a strategic presents

antitrust or other regulatory issues, a

sponsor-strategic partnership might

allow the partners to “split” the business

to avoid such hurdles and create a

transaction that could not be completed

by either partner acting alone

A strategic partner may provide an

opportunity for a sponsor to buy

a target company and “split” the

business based on the assets that are

more attractive to each of the sponsor

or the strategic partner in order to

maximize overall value

If the strategic partner has a strong

credit rating, a sponsor can often

access cheaper debt financing

A strategic partner may provide a builtin

exit opportunity for the sponsor

Recent sponsor-strategic partnership

transactions illustrate some of these

points. Take, for example, the ability

to have a clear exit for the sponsor. In

2017, TPG and WCAS teamed with

Humana to acquire the hospice business

of Kindred. The following year, the

consortium acquired Curo Health

Services for $1.4 billion, which it then

combined with Kindred to create the

largest hospice provider in the United

States. The parties hardwired a path

to exit by agreeing to a series of put/

call mechanics that enable TPG and

WCAS to put their shares in Kindred

(after reflecting the addition of Curo)

to Humana after a period of three

years, with an exercise price multiple

determined by certain agreed-upon

valuation metrics. Similarly, in 2015,

Tenet Healthcare paid $425 million

to buy a controlling stake in United

Surgical Partners, a portfolio company

of WCAS, and negotiated a put/call

structure that gave Tenet a path to full

ownership over five years. In 2018,

Tenet announced it had completed the

purchase of WCAS’s remaining stake.

The OptumHealth/Summit

acquisition of a controlling interest

in Sound Physicians, a physician

staffing company, showcased both

the commercial advantages of a

strategic partner and the effect on the

target’s credit ratings. According to

a ratings report by Moody’s, the B1

Corporate Family rating they gave

Sound Physicians is supported by

its “leading position” as a hospitalist

provider and Moody’s opinion that

the company is “better aligned with

hospitals and payers than many other

physician staffing companies” in light

of OptumHealth’s ownership stake in

the company.

Benefits of sponsor-strategic

partnerships accrue to the strategic as

well. These include deal sourcing for

potential add-on acquisitions, better

management rollover packages to

help retain and motivate management

and key employees, and expertise in

rationalizing the target’s business

and improving its efficiency. More

importantly, a partnership with a private

equity firm provides the strategic with

the opportunity to learn a new business

over an extended period of time with less

economic exposure.

In deals where a strategic sells a piece

of an existing business to a sponsor but

continues to maintain a sizable position

in the investment, the strategic may

partner with the sponsor to avoid a

lengthy auction process, deconsolidate

a (typically underperforming) business,

refocus its resources and management

attention to its core business and record

a gain on sale, while continuing to

participate in the upside of the business

under the stewardship of the sponsor

until an ultimate exit. Examples of such

transactions include the 2018 sale

by AmTrust of 51% of its U.S.-based

fee business to Madison Dearborn

and the 2017 sale by FIS of 60% of its

management consulting business to

Clayton, Dubilier & Rice.

Challenges of Structuring

Sponsor-Strategic Partnerships

Although sponsor-strategic partnerships

can offer clear advantages, realizing

these benefits requires time, effort and

commitment. For one thing, incentives

may not always be aligned: a sponsor

may have a three-to-five-year horizon,

whereas a strategic may have a longerterm

focus. A sponsor and a strategic

may also have differing views about

the optimal exit scenario. For example,

a strategic may want restrictions on

the ability of the sponsor to sell to the

strategic’s competitors. A strategic buyer

may be sensitive to certain issues that

are of less concern to sponsors, such as

regulatory matters and other aspects of

the target that may affect the strategic

buyer’s ongoing business.

These partnerships may provide sponsors with a leg up in

competitive bidding, a clear exit plan and access to more markets,

while strategics may get access to increased deal flow, better

packages to retain and motivate management and expertise in

improving the efficiency of the new business.

Moreover, the key terms of these

partnerships – which are often complex

and critical to a successful outcome –

may have to be negotiated in the midst

of a fast-moving auction process, and

sponsors are often better positioned to

make decisions and act quickly than a

large strategic buyer. It may be difficult

to agree on the terms of a partnership

in time to win a bid, or alternatively,

parties may decide to work out specifics

after a deal has signed, only to find

that they lack a clear understanding

of each other’s interests and goals. In

deals where the sponsor-strategic value

proposition includes entry into longterm

commercial relationships between

the acquired business and the strategic,

these issues can be particularly acute, as

negotiating those arrangements often

requires the input of target management,

access to whom can be difficult outside

of a proprietary process.

Overall, it is critical for the partners to

develop a good working relationship, if

one doesn't already exist, and establish

trust early on in the transaction in order

to set themselves up to be successful.

Best Practices for Sponsor-

Strategic Partnerships

While every sponsor-strategic

partnership is different, there are a

number of best practices that sponsors

should keep in mind when considering

these combinations:

- Define the partnership at the

outset. Discuss the goals of each

party up front. Agree to the greatest

extent possible on key issues with

respect to partnership governance

and go-forward arrangements,

including post-acquisition board

composition and veto rights.

- Have the exit in sight. Formulate a

common understanding of when and

how the sponsor will exit the deal and

discuss potential exit mechanisms,

including a right of offer/first refusal,

put/call rights (including pricing

mechanism for a put/call, although it

may be difficult to agree on a put or call

price in advance) and drag-along rights.

It can take work to align the interests of sponsors and strategics,

with possible sticking points, including different investment

horizons, sensitivity to potential regulatory issues and restrictions

on selling the new company to competitors.

- Consider the implications.

Anticipate the projected impact

the partnership will have on the

contemplated transaction, including

the partnership’s effect on substantive

antitrust analysis and possible

additional regulatory requirements.

In the case of a publicly traded target,

consider whether the combined

holdings of a sponsor and a strategic

partner make them subject to earlywarning

disclosures and, in some

jurisdictions, formal tender offer

and bid requirements.

- Focus on the presentation to the

seller. Consider how best to present

an attractive and unified message

regarding the partnership to a

seller throughout the bid process.

Predict seller concerns with the

sponsor-strategic partnership bid and

proactively offer solutions to avoid a

seller discounting the partnership

bid as too complicated or conditional

to get done.

- Be flexible and creative. These

transactions generally require

solution-oriented and creative

dealmakers to work through issues

efficiently and commercially to

keep the deal on track. Consider

establishing “rules of the road” up

front to be able to move quickly

to respond to changing auction

dynamics and other deal issues that

will inevitably arise throughout

the bidding, negotiation and even

implementation phases.

Armed with an understanding of

what issues have the greatest potential

to create problems down the line, deal

teams can prioritize resolving those

issues earlier in the process, enabling

the parties to focus on working

together to bring a transaction over the

finish line, and ultimately maximize the

value of their partnership to achieve

a successful investment outcome for

both the sponsor and strategic partner.

The Private Equity Report Fall, 2019, Vol 19, No 2