While the English limited partnership is an excellent fund vehicle option, the UK has lacked a competitive, coordinated holding company regime. This gap has led many funds, including several managed by UK teams, to locate their fund and holding structures outside the UK, notably in Luxembourg, where the combined regimes are more established and attractive. However, this strategy has become more challenging, as EU and other jurisdictions increase their scrutiny of holding companies’ “substance,” requiring funds to demonstrate, among other things, that the holding company was not set up in a particular jurisdiction purely to benefit from applicable tax relief.

The UK’s new qualifying asset holding company (“QAHC”) regime, which took effect on April 6, 2022, attempts to address these issues. Not only does it provide funds with a regime that is competitive with alternatives offered in rival European fund centers, but it allows UK-managed funds to easily meet any “substance” concerns, since the UK is a natural choice in which to locate the holding company of a UK-managed fund.

Below, we review the QAHC regime’s key tax consequences and eligibility requirements.

1. Tax Consequences

There are several favourable tax consequences for companies that elect to be a QAHC. The most important of these are set out below.

Exemption from tax on capital gains

A QAHC is not subject to corporation tax on gains arising from the disposal of shares (other than shares in UK “property rich” companies which derive at least 75% of their value from UK real estate) and of overseas real estate. This is a significant improvement over the UK’s complex participation exemption. It also avoids the need to consider participation requirements in other jurisdictions, such as those required for a Luxembourg holding company.

Abolition of UK withholding tax

Payments of interest by a QAHC are not subject to the usual 20% UK withholding tax. While the UK interest withholding tax rules already contain a number of exemptions, this provision will likely remove the administrative burden and cost that might otherwise be incurred in meeting such other exemptions. Since the UK does not impose withholding tax on dividends, the QAHC holding company structure results in the complete absence of UK withholding tax.

Capital gains tax treatment for share buybacks

A key feature of the QAHC regime is that it enables QAHCs to return value to investors through share buybacks. The UK’s “distribution” rules and certain anti-avoidance rules, either of which could otherwise bring such returns within the charge to income tax, will not apply (with some exceptions). The full amount paid by a QAHC to a shareholder on a share buyback will be treated as capital and taxed within the capital gains tax regime. This feature will be of particular benefit to UK resident individual investors, including team members with carried interest or co-invest entitlements. Additionally, there will be no stamp duty or stamp duty reserve tax on the repurchase by a QAHC of its shares or securities.

Deductions allowed for profit participating debt

QAHCs may take a deduction for interest costs on profit participating loans. This will render the QAHC efficient for debt financing structures.

2. Eligibility Requirements

Unlike in other jurisdictions, where holding companies merely fall within the general law, companies seeking to qualify as a QAHC must meet several eligibility conditions. The most significant criteria include the following:

Residence

A QAHC must be UK resident. However, there is no requirement that the company be incorporated in the UK. Companies may be UK resident for tax purposes if incorporated outside the UK, but with their “central management and control” in the UK.

Ownership

The ownership condition limits the size of “relevant interests” that are held by “non-Category A investors” in a QAHC to 30%. Category A investors include a range of investors, such as pension funds, charities, authorised long-term insurance businesses and, most importantly, “qualifying funds” (which are discussed below in more detail).

The term “relevant interest” generally means that a person is beneficially entitled to the QAHC’s profits or assets available for distribution, or if they have voting power in the company in relation to “standard resolutions.” The “relevant interest” provision includes various anti-abuse rules, including specific rules relating to carried interest.

Activity

The QAHC regime requires the main activity of the company to be the carrying on of an investment business. Any other activities of the company must be ancillary to the business and must not be carried out to any substantial extent. This requirement should be relatively simple for most private equity, credit and other private capital funds to meet, although credit funds have expressed some caution regarding loan origination, given that there is longstanding uncertainty as to whether loan origination by an investment fund is to be treated as a trading activity or an investment activity for UK tax purposes.

Investment Strategy

This condition requires that the investment strategy of the potential QAHC does not involve the acquisition of equity securities listed or traded on a recognised stock exchange or any other public market or exchange, or other interests that derive their value from such securities. However, it should be noted that the strategy could involve the acquisition of listed equities for the purpose of facilitating a change of control of the issuer, so that it results in the securities no longer being listed or traded.

3. Qualifying Funds and Diversity of Ownership

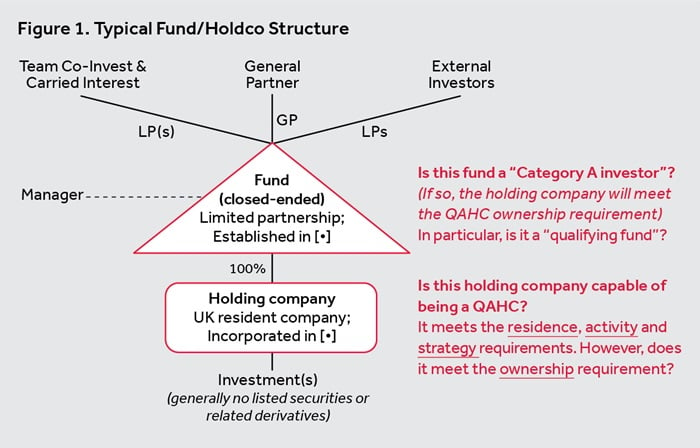

As noted above, the ownership conditions for the QAHC regime will require fund sponsors considering the regime for a wholly-owned company to determine whether the parent fund is a Category A investor and, in particular, a “qualifying fund.” Figure 1 represents a typical structure.

In order to become a “qualifying fund”, a fund must be a collective investment scheme ("CIS") or an alternative investment fund ("AIF") which meets one of the following tests demonstrating “diversity of ownership”: Most investment funds can expect to be either a CIS or an AIF (a principal difference between the two is that a CIS cannot be a “body corporate”).

Genuine diversity of ownership (“GDO”) test

A fund which is a CIS may meet the diversity of ownership condition by relying on the GDO test. Broadly, if such a fund is able to demonstrate that it has marketed itself to a sufficiently broad investor base, it will meet the GDO test. Certain funds, such as separate managed accounts or small, parallel funds, may not be in a position to rely on this test because they are not widely marketed. It is not known why the GDO test was only extended to CIS funds since there would seem to be no policy reason for, essentially, excluding funds that are “bodies corporate”. Determining whether a fund is a “body corporate” involves a highly technical analysis of the vehicle’s legal characteristics and this element represents an uncertain and, potentially, broad exclusion for certain common non-UK fund vehicles (albeit one for which there will often be a solution).

Non-close test

A fund, whether an AIF or a CIS, can also rely on the non-close test to prove diversity of ownership. Broadly, this involves demonstrating that the fund is “controlled” by more than five persons. Like the GDO test, this can probably be met by most widely held funds, but separate managed accounts and small funds may encounter issues. Unlike the GDO test (which, for close ended funds, is conclusively determined during the fundraising process), the non-close test requires monitoring throughout the life of the fund.

70% controlled by Category A investors test

An AIF or CIS that is at least 70% controlled by Category A investors can meet the diversity of ownership condition in this way. This test may be suitable for certain funds, such as sovereign wealth funds. Like the non-close test, this will require monitoring.

4. Conclusion

The introduction of the QAHC regime has generated considerable interest and represents a significant opportunity for the UK to regain its position as an attractive location for asset-holding vehicles. However, fund sponsors should consider their options carefully as some elements of the QAHC eligibility requirements may present challenges and the ownership criteria, in particular, will need to be examined in detail. Furthermore, certain tax reliefs relevant to a fund’s investment structuring, such as reliefs established by EU directives, may only be available to EU holding companies. In addition, some EU countries, such as Spain, offer certain reliefs for domestic companies which are owned by entities domiciled in other EU countries. Nonetheless, the QAHC regime represents the most exciting development in UK investment funds law in many years and we anticipate that it will be used frequently.