Recently, President Biden signed the Inflation Reduction Act, which imposes a 1% excise tax on the fair market value of stock redemptions made by publicly traded corporations beginning January 1, 2023. While the tax will most commonly apply to ordinary course stock buybacks, it may also apply to any portion of the consideration paid in a leveraged buyout of a public corporation that is treated as a redemption for U.S. federal income tax purposes. However, by carefully structuring the acquisition financing, it may be possible for private equity buyers to avoid the impact of this tax.

The Scope of the New Tax

The Act imposes a non-deductible 1% excise tax on the fair market value of stock repurchased by publicly traded corporations or their specified affiliates. The tax applies to both U.S. public corporations and U.S. affiliates of foreign public corporations that are liable for the tax payment, and to all applicable stock repurchased by those corporations, even if the actual shares redeemed are not publicly traded. The Act includes a netting rule that reduces the excise tax base by the fair market value of stock that is issued during the same taxable year, including stock issued or provided to employees.

Notably, the tax does not apply to any distribution or repurchase treated as a dividend for federal income tax purposes. It also does not apply to repurchases (1) that are part of a tax-free reorganization; (2) if the repurchased stock or an equivalent value of stock is contributed to an employee retirement or stock ownership plan; (3) of less than $1 million annually; (4) by a dealer in securities in the ordinary course of business; or (5) by regulated investment companies or real estate investment trusts.

The Excise Tax and Leveraged Buyouts

In the classic leveraged buyout structure of a U.S. public company, the acquirer first sets up a corporate merger subsidiary. Immediately prior to the transaction, the merger sub is capitalized with cash equity and borrows to finance the remaining portion of the purchase price. The cash provided to the merger sub through equity and debt is then used to acquire the shares of the target held by the public. The merger sub and public target combine, with the public company “continuing” as a result of the merger and the merger sub ceasing to exist as a separate entity. The private equity fund’s holding company then becomes the owner of the continuing company. By operation of law, the continuing company succeeds to the assets and liabilities of both the former public target and the merger sub—which, importantly, includes the debt incurred by the merger sub to finance part of the acquisition.

Because the merger sub’s existence is transitory, it is disregarded for U.S. federal income tax purposes. As a result, the portion of the purchase price paid by the merger sub to the public shareholders that was financed with equity from the acquirer is treated as the purchase price paid by the acquirer. The portion of the purchase price financed with third-party debt that ends up within the continuing company post-merger is treated for tax purposes as a redemption of shares of the public shareholders by the formerly public target corporation. So long as the public shareholders are selling all of their shares in the target in the merger (which usually is the case), they are able to treat the proceeds as capital gains, whether those proceeds are classified as purchase price paid by the acquirer or as redemption proceeds. However, the post-merger continuing company would be subject to a 1% excise tax on the portion of the purchase price treated as redemption proceeds.

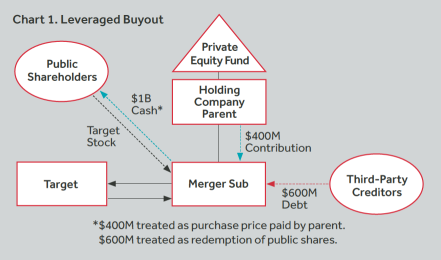

The application of the excise tax on redeemed shares in a classic leveraged buyout structure can be seen in Chart 1. In this example, the public target has a $1 billion enterprise value. To acquire the target, a private equity firm sets up a corporate merger sub. Because the private equity firm believes the target can support a significant debt load going forward, it capitalizes the merger sub with $400 million of equity and causes the merger sub to incur $600 million of third-party debt. In the merger, the shares held by the public are converted into the right to receive $1 billion of cash—$400 million of which is treated as cash purchase price paid by the acquiring private equity firm and $600 million of which is treated as paid out in redemption of shares by the target. Absent some other exception applying, the post-merger continuing company would incur a nondeductible $6 million excise tax on the $600 million redemption.

An Alternative Structure

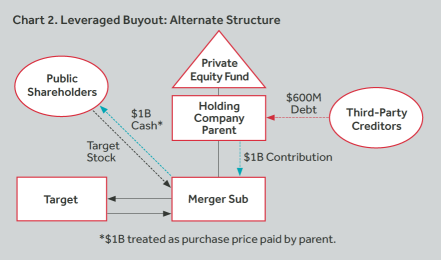

To avoid the application of the excise tax, private equity sponsors should consider financing the acquisition of a public company at the parent level rather than at the merger sub level. In this structure, illustrated in Chart 2, the parent would incur the acquisition debt and then contribute the entirety of the purchase price to merger sub as equity. The merger would continue as described above, but after the transaction was complete, the parent, rather than the continuing company, would be directly liable for the debt (though the continuing company would likely become a guarantor). Because of this—subject to the discussion below—all of the purchase price should be treated for U.S. income tax purposes as having been paid by the parent to the public in exchange for the shares, with none of the purchase price treated as having been paid in a redemption by the target.

Other Considerations

As noted above, while the target would not be an actual obligor of the acquisition debt post-merger, it would be a guarantor. Generally, lenders are comfortable from a legal perspective with lending to a holding company so long as the relevant U.S. operating companies, such as the target and its subsidiaries, are guarantors of the debt. However, the structure may lead to additional financing complexity, including the need to move money up from the target to the parent to service the debt.

In considering the use of this alternative structure, buyers should keep in mind the potential for developments in tax regulation and enforcement. Indeed, the Act gives the Internal Revenue Service broad authority to prescribe regulations to prevent avoidance of the tax, including by extending the tax to transactions that are economically similar to a redemption. Future IRS regulations could treat the payment of the debt-financed purchase price in the alternative structure as redemption proceeds for purposes of the excise tax. Further, the IRS could try to tax a transaction that used this alternative structure as a redemption even without changes to regulations, although we believe the transaction should be regarded as a purchase, rather than a redemption, for general income tax purposes.

Because the post-closing parent will own 100% of the equity interests in the continuing company and both parent and the continuing company are U.S. corporations, parent and target can consolidate for U.S. federal income tax purposes. As a result, the interest expense generated by the acquisition debt at the parent can be used to offset income earned by the continuing company for U.S. federal income tax purposes. However, certain states do not allow for consolidation in this manner, and instead respect the separate company status of the various entities in the structure. In those states, there may be a benefit to pushing down the parent’s acquisition debt to the operating entities, as that allows the interest paid on the debt to be used to offset state income taxes at the operating level. The alternative structure can be adjusted to maximize state tax deductibility of the interest expense by a post-closing restructuring of the financing arrangements, or by using a co-borrower arrangement at the merger sub level to incur a portion of the acquisition debt (not to exceed target’s historic debt). However, care should be taken to ensure that planning to maximize the state tax deductibility of interest or otherwise simplify the structure post-closing does not adversely impact the tax planning that otherwise drives the alternative structure above.