Key Takeaways:

- In terms of deal value, 2025 was a bumper year for M&A in the financial services sector in the UK and Europe.

- With deals in insurance, banks, wealth and asset management leading the way, 2026 is also expected to be a banner year.

- In this paper, we explore some market trends and our predictions for 2026, focusing on a number of the key financial services sub-sectors (wealth management, asset management, banks, non-Life / P&C Insurance / intermediaries, life and pensions, fintech and crypto).

- Debevoise & Plimpton acted on a number of the largest financial services deals in the UK and Europe in 2025 and was a top 10 legal advisor by value.

As 2026 gets underway, this paper takes stock of M&A activity in the financial services (“FS”) sector in the UK and Europe in 2025 and explores some of our predicted market trends for 2026. 2025 was a bumper year in terms of deal value, due to some large “marquee” transactions, but was flatter in terms of overall number of deals.

Debevoise & Plimpton acted on a number of the largest financial services deals in Europe in 2025 and were a top 10 legal advisor by value.

Our key predictions for FS M&A in the UK and Europe in 2026 are (set out in more detail below):

Private equity (“PE”) / alternative investment managers in FS

- We expect PE firms to continue to feature heavily as buyers and sellers across a number of FS sub-sectors. We will also see deals focused on increasing access for alternative asset managers to private credit opportunities or to support asset managers in offering alternative investments to retail customers.

Wealth management

- We expect to see a significant number of wealth manager consolidator sales to strategic buyers.

Asset management

- Consolidation in the sector will continue apace, with larger asset managers looking to expand the asset classes they offer through strategic or majority stake acquisitions of smaller and mid-market and niche players, including via cross-border transactions involving US buyers and European targets. We will also continue to see GP staking transactions.

Banks

- Consolidation of mid-sized banks and, in certain European markets, consolidation at the larger end of domestic banks.

- Now that the Danish Compromise (dealing with the capital treatment of insurance subsidiaries by banks – see below) is permanent, we expect to see more European banks making investments into insurance businesses.

Non-Life / P&C insurance and intermediaries

- Acquisitions of groups with Lloyd’s businesses ramped up last year and are expected to continue as investors seek access to the market’s global licences and specialty lines.

- Sales of insurance intermediary consolidators and possibly IPO exits as the groups increase in size and trade away from PE buyers.

- Transactions to raise third party capital to support insurance businesses through sidecars and London Bridge 2 transactions at Lloyd’s.

Life insurance and pensions

- Further transactions and partnerships between asset managers and insurers in the UK and across Europe as insurers continue to chase access to alternative assets.

- Fewer M&A deals in the UK pension risk transfer (“PRT”) market, but we see the potential for sidecar / insurance-linked securities deals to support the continued growth of the market. We anticipate investments into newly launched pension consolidators.

- More deals focused on the defined contribution (“DC”) pension market specifically.

Fintech and crypto

- Uptick in fintech deal volumes as valuations have adjusted and regulatory regimes have solidified.

V is for Value!

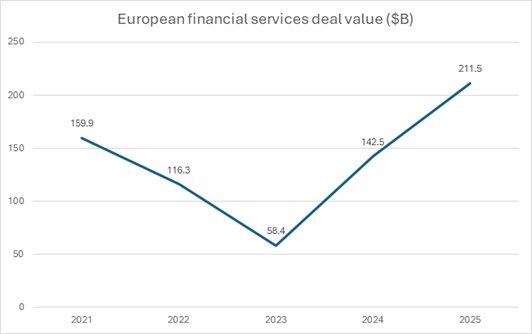

In 2025, financial services M&A deal value in Europe rose from $142.5 billion in 2024 to $211.5 billion, buoyed by deals towards the end of the year in the insurance and banking sectors. Transactions were focused on the higher end, with a number of notable public transactions (for example, the Banca Monte dei Paschi di Siena acquisition of Mediobanca and Brookfield Wealth Solutions acquisition of Just Group). Whilst we see that deal count increased, this was a more modest uplift to 1466 in 2025 versus 1350 in 2024.

Source: Mergermarket. Deals announced/rumoured

Source: Mergermarket. Deals announced/rumoured

The evolving role of private capital

PE has continued to play a big role in transactions, with PE investments in the European financial services sector hitting a record high of $80.9 billion in 2025 - a significant increase of 35.2% from $59.9 billion in 2024. Similarly, the size of the deals that PE is participating in is becoming larger. Good examples are the $2.5 billion investment by Stone Point into Ardonagh and Athora’s acquisition (supported by Apollo) of Pension Insurance Corporation for $6.6 billion.

Source: Pitchbook

The role of PE is evolving, as private capital providers look at acquisitions that support their growth in the private credit markets, such as buying distribution platforms, and continue to buy or participate in insurance businesses where there are asset management opportunities. Early in 2026 we saw CVC and AIG enter into a $3.5bn credit and secondaries partnership. We expect to see more of these strategic partnerships going into 2026.

The regulatory approach to PE investment has also been changing. Whilst there has always been a focus on PE firms as controllers of regulated entities, financial regulators are increasingly focusing on private funds and their potential to offer exposure to private assets to retail customers. Good examples are the FCA’s focus on conflicts of interest and the fair treatment of customers in private markets and the FCA’s recent paper on expanding consumer access to investments (see more detail in our regulatory update paper). All of these regulatory developments have the potential to impact the approach to investments by alternative investment managers looking at the retail market.

Convergence of Sub-Sectors and a Resurgence of Bancassurance

Below, we explore factors driving consolidation trends and some of the regulatory developments which might further impact M&A activity in the key financial services sub-sectors.

The convergence of many of these sub-sectors is of particular interest. Bancassurance has generally been on a decline in Europe, in part due to mis-selling issues, but also due to the potential capital treatment of holding those investments. Under a provision in the EU's Capital Requirements Regulation (CRR), banks were required to deduct insurance holdings in full from their capital, making holding insurance subsidiaries quite burdensome. The ‘Danish Compromise’, however, allows banks to hold capital against their insurance subsidiaries on a risk-weighted basis (rather than wholly deducting it). Initially, this measure was intended to be temporary and it was uncertain how long banks could make use of it. As a result, many banks sought to divest their investments in insurance companies and we saw a number of sales with associated distribution arrangements.

Nevertheless, in January 2025, the Danish Compromise became permanent and as a result, we have started to see renewed interest from banks in the insurance market. European banks are therefore likely to play a bigger role as buyers going into 2026. It is worth noting, however, that the European Banking Authority in January 2026 clarified that the Danish Compromise should not apply to asset managers bought via a bank’s insurance subsidiary and the benefits should be limited to insurance companies.

Beyond banks, we are also seeing insurers and asset managers moving into wider ranges of products in the wealth and pensions markets. And, of course, we continue to see insurers and banks acquiring fintech businesses to add key technologies to their offerings.

Wealth Management Companies

Ownership of client relationships by financial advisors and strong market fragmentation have supported consolidation in the UK financial advice sector, with wealth management companies appealing to PE investors looking to execute roll-ups. However, 2026 heralds a large number of potential exits from PE-backed consolidators and, potentially, an uptick in acquisitions by retail brands to add advisor arms to their offerings to assist cross-selling.

The FCA’s recent review of wealth consolidators had the potential to impact sales processes. However, despite identifying issues with the approach taken by some consolidators, the review has not resulted in rule changes or widespread intervention. The review did, however, flag key items that should be borne in mind by groups when looking at sales processes or groups looking at acquiring consolidators - for example, managing group debt, group risk management and the approach to due diligence on IFA acquisitions. See our briefing note for further information.

Asset Management Companies

Asset management deals continue to be driven by diversification opportunities and economies of scale. However, the more challenging fundraising landscape will continue to trigger smaller managers to consider sales. We saw some large deals with a UK nexus, in the form of the Janus Henderson acquisition by Trian and General Catalyst. However, for the most part, we saw more strategic acquisitions by way of majority stakes (rather than full acquisitions) in businesses that enable asset managers to access new asset classes and growth capital for diversification into new fund strategies. These include deals such as TDR Capital’s acquisition of a majority stake in CorpAcq Limited (a specialist in acquiring SMEs in the UK) and M&G’s acquisition of a majority stake in P Capital Partners (PCP) (a European private credit business in the corporate non-sponsor sector).

Going into 2026, we expect a similar level of activity with asset managers (including insurers with large asset management arms) looking at mid-sized players with new asset classes that they can benefit from and alternative asset managers looking at platforms to assist expansion of their private credit businesses. Increased US interest in European asset managers, driven by US players’ geographic expansion into Europe, is likely to spur more cross-border deals.

Additionally, GP staking transactions are likely to also continue apace (with the likes of established US players such as Blue Owl/Dyal, Blackstone and others) as investors seek to diversify their interests and exposure in asset managers. The launch of European GP staking firms such as Armen (noted as the first native European player in GP stakes) which has been particularly active since closing its first fund in 2023, highlights a growing familiarity with and appetite for these types of deals in Europe.

Finally, succession planning and the need to deliver liquidity to founders of asset management companies is likely to continue to be another key driver for these deals (whether majority buy-outs or GP staking) going forward, adding further momentum to an already dynamic market.

Banks

Despite the political environment resulting in some market uncertainty, dealmaking in the European banking sector increased as banks found themselves under pressure to build scale and invest in technological innovation.

In the UK, we continued to see consolidation, with the Coventry Building Society's purchase of The Co-operative Bank in January 2025. We expect to see more consolidation as mid-sized banks struggle to achieve sufficient scale.

Similarly, we have seen some large banking transactions in Europe such as the French banking group Crédit Mutuel Alliance Fédérale acquiring (via its subsidiary TARGO Deutschland) German lender Oldenburgische Landesbank as well as the failed takeover of Banca Generali.

The European Commission’s pushback against Member State resistance to consolidation in the banking sector will continue to play out. In particular, following infringement proceedings by the EC against Italy for using its foreign direct investment regime to impose conditions on UniCredit’s proposed acquisition of Banco BPM, Italy is now planning to review some of its financial oversight rules.

Also worth noting is the impact of the new EU Capital Requirements Directive (CRD VI) on transaction timelines, as it imposes additional requirements on EU banks to pre-clear mergers and divisions.

Non-Life / P&C Insurance

We also saw a number of larger deals in the property and casualty and non-life sector in the UK and Europe in 2025, with transactions such as the sale of Domestic & General to Asurion and the offer by Zurich for Beazley. Acquisitions of Lloyd’s businesses ramped up last year with the acquisition by Starwind of Apollo Managing Agency and by CRC Group of Atrium Group. Many acquisitions of groups recently contain a Lloyd’s business and we expect this trend to continue as investors seek access to the global licences and specialty businesses at Lloyd’s.

We expect Lloyd’s sales to continue this year fueled by buyer interest and pent up sale demand from private equity groups. The recent offer by Zurich for Beazley may also rekindle interest in the other Lloyd’s listed businesses the market was speculating about a few years ago, namely Hiscox and Lancashire.

However, despite a few large deals in the market likely to happen, we expect deals to be somewhat smaller this year as insurers focus on specialty lines in the UK and Europe.

We also saw last year a large number of insurance groups seeking to access capital for their Lloyd’s businesses via the London Bridge 2 vehicle. London Bridge 2 has become a conduit to channel capital into the market and we expect this trend to continue with many of the large insurance groups looking to execute transactions in 2026.

Insurance Intermediaries and Brokers

We continue to see significant intermediary consolidation, generally driven by PE-backed consolidators. Consolidation has also become more international as established consolidators in the UK and US look to roll out similar strategies across the continent.

A question that is yet to be resolved is the extent to which we will see the ‘consolidation of consolidators’. Much of the consolidation has been driven by PE-backed platforms, which may hit natural limits in terms of size and buyers. However, it is open to debate whether this will trigger IPOs as an alternative exit. See our capital markets outlook for further details regarding the IPO market.

Life Insurance and Pensions

The PRT market will likely remain the most active component of the UK life insurance market. With challenges from the Prudential Regulation Authority over the use of funded reinsurance, we are likely to see interest in sidecar deals and potentially new transactions using the UK insurance linked securities regime to support the growth of that market.

We expect to see the launch of a number of new pension consolidators in the UK and related capital investments to support those vehicles. There is also interest in insurance and pensions services businesses and platforms.

In Europe, following the Allianz consortium’s (that includes BlackRock) acquisition of Viridium, we should see a continual trend of partnerships between alternative asset managers and life insurers.

Across Europe, we will also see alternative investment managers starting to focus on DC pensions opportunities with a view to offering more options to retail customers. Key to how many deals we will see in this market will be the extent to which such alternative asset investment managers believe they can provide value for money to retail customers in line with regulatory requirements. See our briefing on investing in DC master trusts for a further discussion on some of these issues.

Fintech and Crypto

Recent M&A activity in the fintech industry has been driven by challenging fundraising conditions and keen interest by traditional banks looking to transform their payments infrastructure and looking at stablecoin deals.

Further development of regulation in Europe is also likely to trigger sales as smaller organisations look to be brought into groups that are better able to support the additional regulatory burden. For example, the strengthening of the UK safeguarding regime aimed at protecting customers of payments and e-money firms is likely to drive further consolidation as firms face costs to implement additional record-keeping and diligence requirements.

Under new draft legislation, cryptoasset firms will require FCA authorisation before carrying out specified activities, including operating crypto trading platforms and arranging deals in qualifying cryptoassets. New rules are expected to be ready by mid 2026, giving firms time to secure authorisation ahead of implementation in October 2027. We expect dealmaking involving crypto firms to persist in 2026 as clearer regulatory regimes encourage traditional financial institutions to participate in the sector and as firms seek ways to remain compliant with new licensing regimes.

This publication is for general information purposes only. It is not intended to provide, nor is it to be used as, a substitute for legal advice. In some jurisdictions it may be considered attorney advertising.