Introduction

Once a niche strategy, but now an increasingly popular path to liquidity, Continuation Funds allow sponsors to exit from an investment while still keeping control and future upside. This note explains how Continuation Funds work and outlines some of the key issues to consider.

Structuring

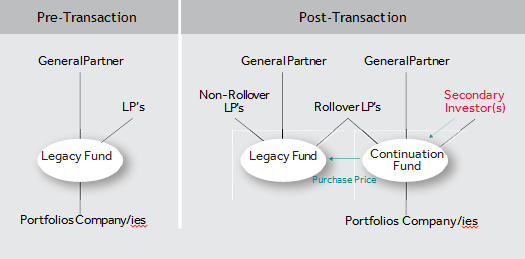

In a typical Continuation Fund transaction, one or more assets of an existing fund (often one that is nearing the end of its term) are acquired by a new vehicle managed by the same sponsor (the “Continuation Fund”). Investors in the existing fund may be offered the option either to sell (i.e. to cash out) or to “roll” their interests into the Continuation Fund (i.e. to remain invested in the underlying asset). New investors will make a cash contribution to the Continuation Fund, providing liquidity for investors in the existing fund who have elected to sell. The terms of the Continuation Fund are negotiated between the sponsor and the new investors, often reflecting asset-specific nuances. At a high level, the transaction structure of a GP-led transaction may look something like this:

When strategically deployed, a Continuation Fund can satisfy diverse stakeholders and achieve multiple goals: providing a liquidity option for investors who want to exit, realigning interests, tailoring incentives, and extending the runway to maximize value creation. However, these are complex transactions, and a weak process can reflect poorly on the sponsor. A successful Continuation Fund involves articulating a clear rationale, creating a transaction structure that solves for the key legal and tax issues, and managing an efficient legal and commercial process.

Framing The Narrative

A significant portion of GP-led secondary transactions are never completed. Common reasons include disagreement on value and concerns about the rationale for the deal. The dynamics of a Continuation Fund can be more complex than a typical portfolio company exit, because the sponsor is effectively on both sides of the deal. To generate an attractive liquidity option, the sponsor must offer a compelling business case and price to prospective buyers. On the other hand, the sponsor also has a fiduciary duty to the existing fund as seller (and, on a more practical note, a sale cannot occur unless a sufficient number of existing investors are incentivized to sell). Sometimes the sponsor may also seek a “stapled” commitment from buyers to another fund being raised by the sponsor, adding a further complication. With conflicting interests at play, it takes the right assets and the right narrative to make a sponsor’s case credible on both sides.

Starting The Process: Engaging Advisors, Diligence and Planning

When considering a Continuation Fund, we strongly recommend consulting with advisors at an early stage. Counsel should review the existing fund and portfolio asset documentation carefully to identify approval requirements and potential gating items such as regulatory issues or transfer restrictions. Tax advisors may be retained to assist with transaction structuring, which can be complex, particularly if the intention is for existing investors to roll into the Continuation Fund without triggering a taxable event. Financial advisors are often hired to help co-ordinate marketing/commercial diligence and investor relations, and to demonstrate a robust valuation and sale process. Sometimes fairness opinions are also obtained. Continuation Fund transactions typically require approval from the Advisory Committee of the existing fund (because they are related- party transactions), and it is a good idea for the sponsor to engage with the Advisory Committee before getting too far down the road. This helps to show transparency and alignment with the investor base, which is critical for a smooth process.

Finding Buyer(s) and Negotiating the Deal

Having assembled its team of advisors, the next step for the sponsor is to identify buyer(s), which may be a single investor or potentially a consortium. Often this is done through an auction process, typically managed by a financial advisor, to assist with price discovery and to mitigate concerns about conflicts of interest on the part of the sponsor.

Once the buyer(s) have been identified, negotiations can be a significant workstream, requiring both funds and M&A expertise. While existing fund terms may be leveraged as a baseline for certain provisions, the key terms for Continuation Fund transactions are typically bespoke, including:

- Fee/Carry. Continuation Fund economics are significantly more variable than the “market” for private equity fund terms. For example, their waterfalls are often more complex, with different rates of carried interest at different return hurdles. Investors from the existing fund may be offered a “status quo” option to maintain their existing economics or they may be offered the opportunity to re-invest on the same economic terms as the new money

- Sponsor Commitment. Buyers will often want the sponsor to commit a significant amount to the Continuation Fund to increase alignment with the sponsor. Sponsors are generally comfortable with this but may also be looking to take some money off the table, particularly if they are realizing significant carry in connection with the transaction.

- Buyer Protections. Key issues for buyers may include the scope of representations and warranties about the asset(s); indemnity caps; the survival period for claims; recourse to the existing fund; the existence of holdbacks or escrows (especially if the existing fund may wind up); and conditions to closing.

- Dry Sometimes the Continuation Fund may include undrawn commitments for follow- on investments in the asset, or other accretive acquisitions. Existing fund investors who re-invest in the Continuation Fund may or may not also make undrawn commitments, which can add complexity to the economics and governance of the Continuation Fund.

- Minimum Sale. Buyers often require a “floor”, i.e. a minimum percentage of interests to be sold by existing investors, to make the deal worthwhile. Sometimes buyers may also have a “ceiling”, i.e. a maximum amount they can invest, meaning that a certain percentage of investors in the existing fund must roll into the Continuation Fund (or additional new investors must be recruited).

As the Continuation Fund involves a fundraising, sponsors should be mindful of applicable regulatory requirements (e.g. filings or approvals relating to fund marketing).

To Sell or to Roll:

Existing Investor Process A disclosure memorandum will be prepared for existing investors. This explains the deal, provides important legal disclosures and includes an election form allowing investors to exit or to roll their interests into the Continuation Fund. Any outstanding approvals from the Advisory Committee or existing investors would also be obtained at this point. (Approval may be sought from existing investors, e.g. if required under the existing fund partnership agreement, or if the sponsor chooses to seek approval from existing investors in addition to the Advisory Committee to further protect themselves from liability risk.)

Closing

Once the election form process has been completed, and any conditions precedent have been satisfied (e.g. regulatory approvals), the transaction can close. The selling investors will receive their proceeds, the existing fund can notch up another exit, and the Continuation Fund will take the asset forward.

The Private Equity Report Fall 2020, Vol 20, No 3